Payments banks a flawed business model, needs relook: former SBI chairman Rajnish Kumar: The veteran banker who is on the boards of nearly a dozen companies talks about the role of independent directors and advisors in emerging companies, the future of payments banks, and more. Former State Bank of India (SBI) chairman Rajnish Kumar seems to have traded in his retirement chair for a whirlwind tour of corporate boardrooms. From advising banking behemoths to mentoring startups such as BharatPe and Byju's, Kumar's post-career journey has been quite eventful. When you retire as the chairman of SBI, there's demand (from companies to join their boards]. I joined the HSBC board first in August 2021, and subsequently got appointed on th L&T board. Hero and Brookfield happened later. I was also approached by Bharat Pe, and I accepted it because it was an upcoming fin-tech startup. At the time, there was nothing to indicate that things were not alright in the company. So, I would say all of this happened by chance, not design. Aggression is alright. Because when you start up, you come up with a new idea. But forgetting the basics can be dangerous. Managing a company when it grows beyond a certain size becomes an issue. In all these companies, governance and compliance were not up to the mark. For instance, Bharat Pe did not have a permanent chief financial officer (CFO). I don't think even Byju's had a CFO of the required stature. When a company is starting from a garage, it is different. But when it is growing, a governing architecture needs to be put in place. For private limited companies, there's no legal requirement to have independent directors or an audit committee. But in BharatPe, we decided to do it appoint independent directors, formulate an audit committee, and bring in a permanent CFO and other professionals. The governance structure must grow in tandem with the company's size. What is the size you're talking about? There is no definition per se, but there are certain benchmarks as per the labour laws. However, there's no benchmark which says that if your company's size is so and so, then you must have a CFO. I believe that every company should have a strong head of finance. That takes care of at least one part, which is financial integrity. The rest is all about business growth and strategy. If you're working in a regulated environment, like say in financial services, then you need to comply with regulations. How has been your experience working with Byju Ravindran? The industry knows him as a charismatic teacher and a founder who built a USD21 billion-dollar ed-tech firm- the second largest startup in India. But clearly, something has gone wrong. In hindsight, I would say that the aggressive expansion by acquiring several companies without having the management bandwidth was avoidable. But that's in hindsight. Otherwise, he is brilliant in terms of what he does. People say he is one of the best teachers in the country but may not be a great businessman. Can you help us understand why? What went wrong at Byju's? When you are growing, it's not a bad idea to have people who have experience of running a corporation of a large size. The entrepreneurs are experienced in a certain way. But when the size of the corporation grows, it becomes a very different model. Now, if you're acquiring say eight companies in a short period of time, the experienced people will sound cautious. You can probably acquire one or two companies, but not seven. How is that wrong from a business standpoint? You have billions of dollars, and you are using that money to grow inorganically. You don't have to raise billions of dollars. If you have money, that is the biggest danger. Startups shouldn't raise money? I am not saying that they should not. They should raise money to meet their business requirements. Even if acquisition is a part of the strategy, you bite off only as much as you can chew. Acquisition and mergers require a lot of planning, due diligence, and bandwidth. Having money doesn't mean that you just go and buy everything. At what point should a founder make way for a professional CEO? Whether you run it yourself as a founder or get a professional - I don't have an issue with that. But having some key managerial personnel is important. Whether it is an advisory board or a normal board, having some people who have seen the corporate world can be helpful. Not only retired bankers but anybody who has been in the corporate world for 20 years. source: et

5% rise expected soon in this metal stock and this industrial player: Nifty traded with small losses and saw a pullback that put it in the positive territory. It was a day of minor technical rebound and consolidation for the markets as Nifty ended the day with small gains. The markets saw a flat start to the day and the Nifty 50 traded with small losses in a range-bound manner until afternoon. In the afternoon, the index saw a pullback which saw Nifty crawling into the positive territory. The second half of the session was spent in a sideways trajectory again but this time, the markets preserved their gains. The headline index closed with a small gain of 32.35 points (+0.15%). Meanwhile, this largecap metal stock is attempting to break out from a sideways consolidation. With the other stocks in the universe having already shown a technical rebound, this stock appears to be on the verge of doing that. HINDALCO formed a lower top at Rs. 587 in February this year. After that, the stock slipped under a corrective decline. The price-decline saw the stock slipping below the 50- and 100-DMA. The recent price action shows that the stock is consolidating below the 100-DMA in a sideways trajectory by oscillating back and forth in a limited range. The 200-DMA is currently placed at Rs. 535. The stock has already rolled inside the improving quadrant of the RRG when benchmarked against the broader NIFTY 500. This is likely to aid the stock improve its relative performance against the broader markets. The OBV hovers near its high. The daily MACD is in continuing buy mode. The RSI stands neutral and does not show any divergence against the price. An anticipated resolution of this consolidation can take the stock higher to Rs. 560 levels over the coming days. Any close below Rs. 510 would negate this technical setup. Milan Vaishnav, CMT, MSTA, is a Technical Analyst This midcap industrial gases and engineering company has made a breakout from the trendline resistance. This breakout can trigger a potential up-move in the stock by close to 5%. Thus, the current levels make it attractive to buy with a favourable risk-reward ratio. Buy Recommendation: Linde India Ltd: After forming a top near Rs. 6764 in October last year, the stock price of Linde India Ltd (LINDEINDIA) witnessed a correction resulting in a price decline. This downmove halted near the 200-day MA at Rs. 5390 levels where it took support multiple times and showed signs of resumption of an up-move. While moving higher, the stock price crossed the 50-day as well as 100-day MA, indicating the near-term trend turning bullish again. source: et

Top Nifty50 stocks analysts suggest buying this week: Refinitiv, is a comprehensive research report that evaluates five key components of 4,000+ listed stocks earnings, fundamentals, relative valuation, risk and price momentum to generate standardized scores. Simple average of the above- mentioned five component ratings is normally distributed to reach an average score. The following list of stocks in the headline index Nifty50 were given a "Strong Buy/Buy" recommendation in the latest Stock Reports Plus report dated March 18, 2024. Analysts' recommendations are provided using Institutional Brokers' Estimate System (IBES) to provide you actionable insights. You can also check the breakdown of the count of analysts' giving buy/sell/hold recommendations to each stock in the index. List of Nifty50 stocks with 'Strong Buy/Buy' recommendations and average scores of 8- 10 Company Name Average Score Analysts' Mean Recommendation Strong Buy/Buy Count Hold Count Reduce/Sell Count ICICI Bank Ltd 10 Strong Buy 36 3 0 Adani Ports and Special Economic Zone Ltd 9 Strong Buy 17 1 0 Axis Bank Ltd 10 Buy 36 3 0 Hero MotoCorp Ltd 10 Buy 21 6 8 Tata Motors Ltd 10 Buy 20 5 4 Maruti Suzuki India Ltd 10 Buy 28 6 3 State Bank of India 10 Buy 31 6 3 Oil and Natural Gas Corporation Ltd 10 Buy 15 5 5 Coal India Ltd 9 Buy 12 3 2 UltraTech Cernent Ltd 9 Buy 28 4 2 Bharti Airtel Ltd 9 Buy 17 7 1 Mahindra and Mahindra Ltd 9 Buy 33 3 0 Larsen and Toubro Ltd 9 Buy 26 2 2 Indusind Bank Ltd 9 Buy 36 4 1 Cipla Ltd 9 Buy 21 5 6 Reliance Industries Ltd 8 Buy 22 4 2 Kotak Mahindra Bank Ltd 8 Buy 19 14 3 NTPC Ltd 8 Buy 18 0 3 Hindalco Industries Ltd 8 Buy 19 1 2 ITC Ltd 8 Buy 33 3 0 Sun Pharmaceutical Industries Ltd 8 Buy 26 5 1 source:et

Stock Radar: Infosys showing signs of bottoming out after recent fall; May buy? Infosys: Short-term traders can look to buy the stock on dips for a possible bounce back towards 1,800 levels in the short term, suggested experts. The stock gave a breakout from a Declining Channel resistance on the weekly charts in November 2023 and since then it has been trading in an uptrend. It hit a record high in February 2024 but witnessed mild consolidation. The stock found support above 1500 levels earlier in March and is showing signs of a bounce back. Infosys, a part of the S&P BSE Sensex index, has fallen over 5% from its February 2024 high but the price action suggests that the stock is showing signs of bottoming out. The S&P BSE Sensex stock hit a record high of Rs 1,731 on February 6, 2024, but failed to hold on to the momentum. Infosys is a global leader in next-generation digital services and consulting. It is part of the S&P BSE Sensex and has a market capitalisation of Rs 6.7 lakh crore as of March 18, 2024. The stock gave a breakout from a Declining Channel resistance on the weekly charts in November 2023 and since then it has been trading in an uptrend. It hit a record high in February 2024 but witnessed mild consolidation. The stock found support above 1500 levels earlier in March and is showing signs of a bounce back. Infosys is a low-beta stock and has shown resilience amid the volatility seen in the markets. It is trading below most of the crucial short-term moving averages. "We are seeing noticeable resilience in the IT pack amid the prevailing choppiness. Within the space, the IT majors, we like Infosys," said Ajit Mishra, SVP - technical research, Religare Broking Ltd. source:et

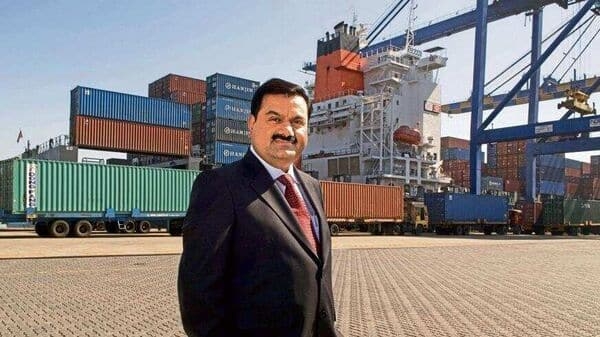

अदाणी समूह के शेयरों में गिरावट से एमएफ दूर हैं। क्या चलेगा संदीप टंडन का कॉन्ट्रा दांव? क्वांट म्यूचुअल फंड के संदीप टंडन फरवरी में अदानी ग्रीन एनर्जी के सबसे बड़े खरीदार थे। म्यूचुअल फंड ने स्टॉक के 1 मिलियन से अधिक शेयर खरीदे। समूह की कंपनियों में भी, क्वांट एमएफ ने 3 मिलियन शेयरों का अधिग्रहण किया है, जिससे अदानी समूह की कंपनियों में इसकी कुल हिस्सेदारी लगभग 50 मिलियन हो गई है। क्या क्वांट एमएफ का विरोधाभासी रुख सही साबित होगा? अदाणी समूह के शेयरों के लिए यह "एक बार फिर से नया दौर" है। कंपनी मुश्किल में है और इस बार अमेरिकी नियामक कथित धोखाधड़ी के लिए इसकी जांच करना चाहते हैं। यह कदम ऐसे समय में एक बड़ा झटका है जब समूह का कर्ज स्थिर हो गया था और उसके नकदी प्रवाह में सुधार हुआ था। जबकि अदानी समूह एक विदेशी संस्थागत निवेशक जीक्यूजी पार्टनर्स को कंपनी में 2.2 बिलियन अमेरिकी डॉलर लगाने के लिए आकर्षित करने में सफल रहा है, एक को छोड़कर अधिकांश घरेलू म्यूचुअल फंड दूर रह रहे हैं। 15 मार्च को, अडानी समूह फिर से गलत कारण से सुर्खियों में था, क्योंकि समूह के अधिकांश शेयर प्री-हिंडनबर्ग ऊंचाई के करीब थे। ब्लूमबर्ग समाचार रिपोर्ट के अनुसार, कंपनी की जांच न्यूयॉर्क के पूर्वी जिले के अमेरिकी अटॉर्नी कार्यालय और वाशिंगटन में न्याय विभाग की धोखाधड़ी इकाई द्वारा की जा रही है। जांच अदानी ग्रीन के संस्थापक, गौतम अदानी के आचरण पर केंद्रित है और जांच की जा रही है कि क्या कंपनी या अदानी रिश्वतखोरी में शामिल हो सकते हैं। इसमें अडानी समूह पर एक ऊर्जा परियोजना पर अनुकूल व्यवहार के लिए भारत में अधिकारियों को भुगतान करने का आरोप लगाया गया है। इस पर अमेरिकी नियामक की ओर से कोई और स्पष्टता या आधिकारिक पुष्टि नहीं हुई है। इस बीच, सप्ताहांत में अदानी समूह ने वित्त वर्ष 2015 के लिए पूंजीगत व्यय में USD14 बिलियन का निवेश करने की अपनी योजना की घोषणा की, जो उसके USD10 बिलियन के अनुमानित निवेश से 40% अधिक है। इसमें से 70% हरित ऊर्जा क्षमता के निर्माण के लिए समर्पित किया जाएगा, शेष हवाई अड्डों और बंदरगाहों पर जाएगा। लेकिन यह अभी भी स्पष्ट नहीं है कि कंपनी इतनी बड़ी रकम कैसे जुटाएगी। सूचीबद्ध अदानी कंपनियों (अडानी के नाम से पहले) ने वित्त वर्ष 2023 में परिचालन गतिविधियों से 50,000 करोड़ रुपये और वित्त वर्ष 24 की पहली छमाही में लगभग 31,000 करोड़ रुपये का नकदी प्रवाह उत्पन्न किया। इन कंपनियों का कुल कर्ज सितंबर के अंत में 2.18 लाख करोड़ रुपये था, जबकि वित्त वर्ष 23 में यह 2.2 लाख करोड़ रुपये था। हिंडनबर्ग रिपोर्ट जारी होने के बाद से, अदानी समूह में धन उगाहने की गतिविधि सुस्त हो गई है। कंपनी ने इस महीने की शुरुआत में अपने ऋण के पुनर्वित्त के लिए अमेरिकी डॉलर बांड जुटाया था, जो परिपक्वता के करीब है। पिछले साल जनवरी में अदानी एंटरप्राइजेज के फॉलो-ऑन सार्वजनिक प्रस्ताव को रद्द करने के बाद, इक्विटी के माध्यम से धन उगाहना भी सीमित कर दिया गया है। कंपनी के इक्विटी बाजार में कदम नहीं रखने का एक कारण निवेशकों के बीच दिलचस्पी की कमी हो सकती है। दिसंबर 2022 और दिसंबर 2023 के बीच, खुदरा निवेशकों (1 लाख रुपये तक की शेयर पूंजी) ने अदानी टोटल गैस में अपनी हिस्सेदारी 4 प्रतिशत अंक और अदानी एनर्जी सॉल्यूशंस में 2 प्रतिशत अंक बढ़ाई है। समूह की बाकी कंपनियों में इन निवेशकों ने अपनी हिस्सेदारी केवल 1 प्रतिशत अंक बढ़ाई है। एमएफ खेल: इसी अवधि के दौरान समूह की सभी कंपनियों में म्यूचुअल फंड की हिस्सेदारी स्थिर रही है, अदानी पावर को छोड़कर जहां हिस्सेदारी 1 प्रतिशत अंक बढ़ी है और अदानी पोर्ट्स और एसईजेड जहां उन्होंने हिस्सेदारी में 1 प्रतिशत अंक की कटौती की है। सामान्य तौर पर, क्वांट जैसे म्यूचुअल फंड, जो दीर्घकालिक निवेश रणनीति का पालन करते हैं, अदानी समूह में निवेश नहीं कर रहे हैं। ये स्टॉक उच्च बीटा हैं (1-वर्षीय बीटा 1.4 से 2 है)। पिछले कुछ वर्षों में जहां उन्होंने निवेशकों को जबरदस्त रिटर्न से पुरस्कृत किया है, वहीं इसके परिणामस्वरूप भारी नुकसान भी हुआ है। हिंडनबर्ग के बाद, समूह का बाजार पूंजीकरण 19 लाख करोड़ रुपये से आधे से भी अधिक हो गया। अमेरिकी जांच में कॉरपोरेट गवर्नेंस अनुपालन की कमी का संकेत मिलने के साथ, अडानी में निवेश किया जा रहा है आने वाले कुछ दिनों में समूह की कंपनियां फायदेमंद होने की बजाय जोखिम भरी हो सकती हैं। ऐसी स्थिति में, कंपनी लंबी अवधि में उत्पादन करने वाली संपत्ति बनाने के लिए धन कैसे जुटाएगी रिटर्न? शायद यही कारण है कि घरेलू म्यूचुअल फंड जैसे दीर्घकालिक निवेशक अभी भी अडानी समूह की कंपनियों पर दांव लगाने को तैयार नहीं हैं। source: et

GIFT निफ्टी 80 अंक नीचे; आज के सत्र के लिए ट्रेडिंग सेटअप: फिल्स की शुद्ध कमी शुक्रवार को 57,390 करोड़ रुपये से बढ़कर सोमवार को 61,315 करोड़ रुपये हो गई। विदेशी पोर्टफोलियो निवेशक सोमवार को 2,051 करोड़ रुपये के शुद्ध विक्रेता रहे। घरेलू संस्थागत निवेशकों ने 2260 करोड़ रुपये के शेयर खरीदे. सोमवार को उतार-चढ़ाव भरे कारोबार में इक्विटी बाजार बढ़त के साथ बंद हुए, लेकिन व्यापक बाजार का प्रदर्शन कमजोर रहा। विश्लेषकों को उम्मीद है कि अगले कुछ दिनों में बाजार मजबूत होगा जबकि व्यापक बाजार में नरमी बनी रह सकती है। एनएसई IX पर गिफ्ट निफ्टी 83 अंक या 0.37 प्रतिशत की गिरावट के साथ 22,053.50 पर कारोबार कर रहा था, जो दर्शाता है कि दलाल स्ट्रीट मंगलवार को नकारात्मक शुरुआत की ओर बढ़ रहा था। • टेक व्यू: निफ्टी का अल्पकालिक रुझान सीमाबद्ध कार्रवाई के साथ सकारात्मक बना हुआ है। 21900-21850 के समर्थन के नीचे एक निर्णायक ब्रेक निफ्टी को शीघ्र ही 21500 के स्तर तक नीचे खींचने की संभावना है। एचडीएफसी सिक्योरिटीज के नागराज शेट्टी ने कहा कि यहां से कोई भी ऊपरी उछाल 22200 के स्तर के आसपास मजबूत बाधाओं का सामना कर सकता है। • भारत VIX: भारत VIX, जो बाज़ारों में भय का माप है, 1.5% बढ़कर 13.90 के स्तर पर बंद हुआ। एफएंडओ प्रतिबंध में स्टॉक आज 1) ज़ी 2) एबीएफआरएल 3) मणप्पुरम 4)आरबीएल बैंक 5) जलयात्रा 6) टाटा केमिकल्स 7) बीएचईएल 8) नाल्को 9) पीईएल 10)बलरामपुर चीनी मिल्स 11) बायोकॉन 12) हिंदुस्तान कॉपर एफएंडओ सेगमेंट के तहत प्रतिबंध अवधि में प्रतिभूतियों में वे कंपनियां शामिल हैं जिनमें सुरक्षा बाजार-व्यापी स्थिति सीमा का 95% पार कर गई है। source;et

लेनदार लिबर्टी ऑयल ऋण नीलामी में और अधिक चाहते हैं: लिबर्टी ऑयल मिल्स, एक खाना पकाने की तेल कंपनी, स्पष्ट मक्खन, वनस्पति तेल, वसा और बेकरी उत्पादों के निर्माण के साथ-साथ खाद्य तेलों के शोधन और व्यापार में लगी हुई है। इंडिया रेटिंग्स की रिपोर्ट के अनुसार, इसकी वार्षिक क्षमता 650,000 मीट्रिक टन से अधिक है और पश्चिमी भारत में मजबूत उपस्थिति वाली छह प्रसंस्करण सुविधाएं हैं। एक अदालती दस्तावेज़ के अनुसार, 2018 में शुरू किए गए भारतीय रिज़र्व बैंक के दिशानिर्देशों के अनुसार खरीदार की क्रेडिट निकासी और उच्च सीमा शुल्क भुगतान के बाद कंपनी को नकदी प्रवाह विसंगतियों का सामना करना शुरू हुआ। दिवालिया लिबर्टी ऑयल मिल्स का ऋणदाता बैंक ऑफ इंडिया एक बाध्यकारी बोली से जुड़ी स्विस नीलामी की तैयारी कर रहा है, जो बुक वैल्यू की 66% वसूली की गारंटी देती है। फीनिक्स एआरसी ने ₹126 करोड़ के ऋण के लिए ₹82 करोड़ की बोली लगाई है, जिसके कारण ऋणदाता ने आगे की बोलियां तलाशने के लिए 22 मार्च को स्विस नीलामी निर्धारित की है। ₹82 करोड़ के आरक्षित मूल्य और 5% की न्यूनतम मार्कअप आवश्यकता के साथ निर्धारित नीलामी में ₹86 करोड़ से शुरू होने वाली काउंटर बोलियां मांगी गई हैं। फीनिक्स एआरसी और बैंक ऑफ इंडिया दोनों के प्रवक्ताओं ने टिप्पणी के अनुरोधों का तुरंत जवाब नहीं दिया। source: et

सरकार ने कुछ एम एंड ए सौदों को सीसीआई अनुमोदन आवश्यकता से छूट देने का प्रस्ताव किया है: कॉरपोरेट मामलों के मंत्रालय द्वारा भारतीय प्रतिस्पर्धा आयोग (सीसीआई) की मंजूरी आवश्यकता से संयोजनों की कुछ श्रेणियों को छूट देने के लिए मसौदा नियम जारी किए गए हैं। जेएसए एडवोकेट्स एंड सॉलिसिटर्स में प्रतिस्पर्धा कानून के पार्टनर और प्रमुख वैभव चौकसे ने कहा कि मसौदा नियमों में कुछ प्रकार के एम एंड ए (विलय और अधिग्रहण) लेनदेन को शामिल किया गया है, जिन्हें सीसीआई से अनुमोदन की आवश्यकता नहीं होगी। सरकार ने इंट्रा-ग्रुप लेनदेन और कुछ अन्य विलय और अधिग्रहणों को प्रतिस्पर्धा आयोग की मंजूरी की आवश्यकता से छूट देने का प्रस्ताव दिया है, एक ऐसा कदम जिससे निगरानी पर नियामक बोझ को कम करने में मदद मिलने की संभावना है। कॉरपोरेट मामलों के मंत्रालय द्वारा भारतीय प्रतिस्पर्धा आयोग (सीसीआई) की मंजूरी आवश्यकता से संयोजनों की कुछ श्रेणियों को छूट देने के लिए मसौदा नियम जारी किए गए हैं। जेएसए एडवोकेट्स एंड सॉलिसिटर्स में प्रतिस्पर्धा कानून के पार्टनर और प्रमुख वैभव चौकसे ने कहा कि मसौदा नियमों में कुछ प्रकार के एम एंड ए (विलय और अधिग्रहण) लेनदेन को शामिल किया गया है, जिन्हें सीसीआई से अनुमोदन की आवश्यकता नहीं होगी। उन्होंने कहा कि इनमें इंट्रा-ग्रुप लेनदेन, कुछ प्रकार के अल्पसंख्यक और बढ़ते अधिग्रहण और राइट्स इश्यू शामिल हैं क्योंकि इनका बाजार में प्रतिस्पर्धा पर कोई प्रभाव नहीं पड़ेगा। उनके अनुसार, नियम एम एंड ए लेनदेन की छूट वाली मौजूदा श्रेणियों को प्रतिस्थापित और संशोधित करेंगे। नियम एम एंड ए लेनदेन के पक्षों के बीच ओवरलैप को मैप करने के लिए आवश्यक संबद्ध परीक्षण को भी संशोधित करते हैं। source:et

टाटा संस ने टीसीएस का 9,300 करोड़ रुपये का हिस्सा बेचने की योजना बनाई है: टाटा संस टाटा समूह की होल्डिंग कंपनी के रूप में कार्य करती है: TCS में टाटा संस की 72.38% हिस्सेदारी थी। सोमवार को बीएसई पर स्टॉक 1.75% फिसलकर 4,144.75 पर पहुंच गया। टीसीएस का बाजार पूंजीकरण ₹15 लाख करोड़ के ठीक उत्तर में है, जो टाटा समूह की सभी सूचीबद्ध कंपनियों के कुल बाजार मूल्य ₹31.09 लाख करोड़ का लगभग आधा है। टाटा कंसल्टेंसी सर्विसेज (टीसीएस) की होल्डिंग कंपनी टाटा संस ने मंगलवार को भारत के सबसे बड़े सॉफ्टवेयर सेवा निर्यातक में 23.4 मिलियन शेयर कम से कम ₹9,300 करोड़ में बेचने की योजना बनाई है, जैसा कि सौदे के बैंकर जेपी मॉर्गन द्वारा जारी एक टर्म शीट में दिखाया गया है। स्टॉक के लिए न्यूनतम मूल्य, जो कि कंपनी के इक्विटी आधार का 0.65% है, ₹4,001 प्रत्येक पर निर्धारित किया गया है, जो सोमवार के समापन मूल्य पर 3.6% की छूट दर्शाता है। मूल्य के हिसाब से देश में दूसरा सबसे बड़ा स्टॉक, पिछले एक साल में बायबैक कार्यक्रम के कारण 30% बढ़ गया है। टाटा समूह 91,000 करोड़ रुपये के निवेश से गुजरात के धोलेरा में देश का पहला सेमीकंडक्टर फैब्रिकेशन प्लांट स्थापित कर रहा है। टाटा 27,000 करोड़ रुपये के निवेश के साथ असम में टाटा सेमीकंडक्टर असेंबली और टेस्ट की आगामी चिप असेंबली और परीक्षण इकाई भी स्थापित कर रहा है। टाटा संस की अगले कुछ वर्षों में टाटा डिजिटल में एक अरब डॉलर और निवेश करने की योजना है। इसने पहले ही न्यू ऐप में 2 बिलियन डॉलर से अधिक का निवेश किया है और पांच साल की अवधि में और पूंजी निवेश के लिए बोर्ड की मंजूरी मिल गई है। टीसीएस ने दिसंबर में 17,000 करोड़ रुपये में 40.9 मिलियन शेयर वापस खरीदे। नवीनतम बायबैक के परिणामस्वरूप, टाटा समूह की सबसे बड़ी कंपनी में प्रवर्तक इकाई की संयुक्त हिस्सेदारी 72.3% से बढ़कर 72.41% हो गई। लिस्टिंग योजनाएँ: अलग से, टाटा संस, जो टाटा कैपिटल का मालिक है, को भारतीय रिजर्व बैंक के नियमों का पालन करने के लिए सितंबर 2025 तक सूचीबद्ध होना आवश्यक है। source:et

Mar 20 2024, 07:55

- Whatsapp

- Facebook

- Linkedin

- Google Plus

0