How G7 and EU are weaponising diamonds and carbon: In the wake of the Ukraine war, the West tried every trick in the diplomatic playbook to get India to loosen ties with Russia. After that strategy failed, it is using trade to force New Delhi's hand,. India polishes 10 out of the 11 rough diamonds the world mines. It is a global monopoly the world envies. Since the West imposed sanctions on Russia following its invasion of Ukraine, the US and Europe have been fuming over India continuing to trade with Moscow, especially in crude oil. Frustratingly, they cannot out of self-interest - stop India from buying Russian crude because Indian refineries ship the finished product, including diesel, to Europe which needs a regular supply of diesel. Indian diamantaries had anyway stopped buying rough diamonds from Russia following Western sanctions, replacing them with roughs bought from the trading division of Anglo-American mining conglomerate De Beers for polishing and export. But the G7's diktat to certify all rough diamonds at Belgium's new traceability centres from September means Indian exporters will have to ship roughs to Brussels before getting them back certified as not being of Russian origin before refining and exporting them. This will add to their overall costs. While the G7's new diamond export rule is aimed at India, the world's largest processor of rough diamonds, the new carbon tax levied by the European Union (EU) is designed to penalise developing countries. Called the Carbon Border Adjustment Mechanism (CBAM), the tax kicks in from 2026. But exporters of steel, cement and other products whose manufacturing process carries a significant carbon footprint have had to submit detailed documentation of their processes every two months starting from October 2023. "US foreign policy has long been suffused with militarism, unilateralism, and hypocrisy. The problem goes far beyond Iraq. Think about Vietnam, Cambodia, Laos, Nicaragua, Serbia (1999), Afghanistan (both 1979 and 2001), Syria (the CIA-led attempt to overthrow Assad), Libya, and Ukraine (Yanukovych's overthrow). "The UN Security Council should be forging a path to peace, one that is based on Ukraine's neutrality. But the UNSC has not even tried to find a negotiated path to peace. source: et

As crude prices rise, should worry about India's strategic oil buffer? India's oil demand is growing amid the global volatility around crude supply and prices. The country has just 75 days of strategic oil buffer, while China, the top oil-importing nation ahead of india, maintains six months of cushion. The country now consumes more than double the petrol it used a decade ago. Its diesel consumption is up by about a third, while the overall oil demand has risen by half, the latest government data shows. This is obviously a sign of a growing economy. But it also has a doomy message for the fisc of a country, which depends heavily on imports to meet its domestic oil demand. For, Brent crude prices are once again moving towards USD90 levels and might hit USD100 per barrel soon. Does India, the world's third-largest oil consumer and importer, have the preparedness to tackle any massive global supply crunch or price rise? Does it have enough strategic reserves for a rainy day? FY24 saw a muted growth in the country's oil and gas production, while the dependency on imports rose. As domestic demand increased, imports went up to 87.7% in the current fiscal till February against 87.2% in FY23, as per the latest data from the government's Petroleum Planning and Analysis Cell. According to the International Energy Agency's (IEA) World Energy Outlook 2022, India's energy consumption will double by 2040, growing at about 3% per annum, compared to the global average growth rate of 1%. The reasons for India's rising energy demand primarily area growing population-soon to be the world's largest and a period of rapid economic growth. The outlook also forecasts that India's share in global energy demand will double to 11% from 6% now the fastest growth in that period for any country. The importance of strategic storage In 2020, the global crude witnessed the biggest fall in 20 years. India took advantage of the depressed prices and filled its caverns at around USD20 per barrel. This was partially used during February-March 2022, when oil prices breached the USD100 per barrel-mark. As oil prices are rising again, a good buffer stock could be useful to partially absorb an abnormal spike in the global oil prices. Today, the Israel-Hamas conflict, the Russia-Ukraine war, and the Red Sea crisis have reinforced the need for India to strategically build its crude oil storage reserves. source: et

Small cut in the fuel price a big hit to OMC revenue: Analysts Earnings may fall by Rs 30kcer due to March 15 decision to slash petrol, diesel prices by Rs 2, say analysts. This is the first fuel revision by the OMCs in nearly two years-the last was on April 6, 2022. Despite major volatility in global oil prices due to the Russia-Ukraine war and unrest in West Asia, India pump prices have remained steady. The price cut of Rs 2 per litre for petrol and diesel by the state-run oil marketing companies (OMCs)--Indian Oil Corp. (IOCL), Hindustan Petroleum Corp. (HPCL) and Bharat Petroleum Corp. (BPCL)--will erode their revenue and ebitda, according to analysts. The government had announced the price cut with effect from March 15, a day before general election dates were announced. "Although small on headline, a Rs 2 per litre cut will reduce OMC revenue/ebitda by about Rs 30,000 crore ($3.7bn) annualised," JP Morgan said in March 15 report, adding that "the latest data suggests Russian crude discounts have fallen further. Put together, these should remove the current super-normal profitability at the three companies." A senior OMC official said the companies are hoping the fuel price cut is effective only for the next three months and that crude does not turn too volatile. Oil prices hovered near a fourmonth high at $85 a barrel, on Friday after the International Energy Agency (IEA) revised its 2024 oil demand forecast higher. IEA said world oil demand will rise by 1.3 million barrels per day (bpd) in 2024, up 110,000 bpd from last month. In a report, Motilal Oswal said since there is no indication of any excise duty relief from the central government, it appears that the price cut will be borne entirely by the OMCs. They are currently pricing in net marketing margins of Rs 1.7-2.7 per litre. The price cut implies that net marketing margins will decline to Rs 0.8-0.9 per litre. "We estimate every `0.5 per litre cut to net marketing margin would reduce FY25E Ebitda for HPCL/BPCL/IOCL by 16%/13%/11%, respectively," Goldman Sachs said in a March 15 report. "In the near term, OMCs will mark down retail fuel inventories and partly negate the inventory gain from higher crude for F24," Morgan Stanley said in its report. source: et

Climate change turning adverse to rice crops: Climatic conditions turning adverse to rice crops in parts of Pakistan and China. Then came the issue of accessibility of ports due to the Ukraine war. It led to a sudden rise in the price of rice and some other agri commodities. Then came the reaction of the government, ban on exports of select quality and segment of rice. Will this bring an opportunity for rice exporting companies of India and also the retail investors? If one looks at bottomline branded rice sellers, it has been better than expected. However the agri sector is not very stocks have a recommendation, probably because they are largely small and mid-cap in nature. Important issue is whether retail investors should look at these stocks as tactical plays or as long term investment. To understand whether the up trend would be sustained or not. climatic changes are concerned, they keep happening in different parts of the world and impact different crops. The current wave of rising prices brings in a mixture of head and tailwinds. Companies which are exporting rice and that too branded are likely to stay a healthier bottomline. A key thing to watch would be whether there is any increase in institutional shareholding in these stocks in coming months. if that is the case then would lead to a kind of re-rating in long term. Rice sector stocks - Upside potential Oct 6, 2023 Company Name KRBL Avg Score 8 Reco Analyst Count 1 12.1 Upside Potential% Market Cap Rs Cr Inst Stake% 2.7 Market Cap Type Mid 9,031 LT Foods Company Name Avg Score 9 Reco LT Foods Limited is a consumer food company. The Company operates through the manufacture and storage of rice segment. Chaman Lal Setia Exports Limited is a company which is engaged in the business of milling and processing of basmati rice. Kohinoor Foods Limited is a company that is engaged in the business of manufacturing, trading, and marketing food products. source:et

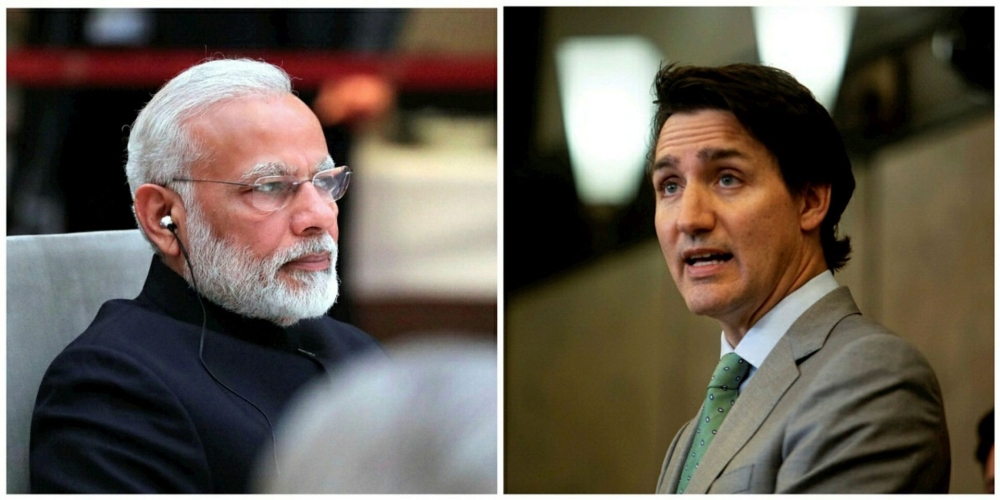

USD100 billion, big-ticket FDIs;Canada with India: The ongoing diplomatic crisis between India and Canada can have a full-blown economic impact. Over the years, Canadian investors and pension funds have invested billions of dollars in Indian stock and debt markets, and in key sectors like infra, green energy, tech, and financial services. There are also deep cultural, people-to-people, and educational ties which could be hit. Diplomatic ties, at stake are big-ticket foreign direct investments (FDIs) from Canada, trade relations worth billions of dollars, friendly people-to-people contact, and much more. Nearly 600 Canadian companies, including the big ones such as Bombardier and SNC Lavalin, have presence in India. The top Indian entities where Canadian firms have investments include ICICI Bank, Kotak Mahindra Bank, Paytm, Zomato, Nykaa, Delhivery, Wipro, and Infosys. Bilateral trade between the two countries had risen in 2022 despite the shadow of the pandemic and the disruptions caused by the war in Ukraine. Invest India, an India government-led organisation aimed at giving a fillip to investments in India on its main Canada page has a big photo of Justin Trudeau and Narendra Modi saying “India-Canada: Natural allies and partners towards growth”. Canada and India have been working toward a Comprehensive Economic Partnership Agreement and a Foreign Investment Promotion and Protection Agreement (FIPA/ BIPPA). Farwa Aamer, director of South Asia initiatives at the Asia Society Policy Institute in New York, says, "The Canada-India relationship finds itself at a critical juncture, characterised by a web of escalating tensions and uncertainties. source:et

#ukrainepresidentvolodymyrzelenskysuggests_ceasefire क्या खत्म होगा रूस-यूक्रेन जंग? सीजफायर को तैयार जलेंस्की रूस और यूक्रेन के बीच ढाई साल से अधिक समय से युद्ध जारी है। अमेरिका समेत यूरोप के कई देश खुलेआम रूस के खिलाफ यूक्रन की मदद कर रहे हैं। बाइडेन ने यूक्रेन को ATACMS मिसाइलों से रूस पर हमले की मंजूरी दी। इसके बाद यूक्रेन ने रूस पर मिसाइलें दाग भी दी। यूक्रेन ने अमेरिकी और ब्रिटिश मिसाइलों की मदद से रूस पर कई हमले किए। इसके जवाब में रूस की ओर से इस युद्ध में पहली बार इंटरकॉन्टिनेंटल बैलिस्टिक मिसाइल का इस्तेमाल किया गया। इस बीच दोनों देशों के बीच युद्ध की आशंका बढ़ गई है। गहरी होती युद्ध की आशंका के बीच यूक्रेन के राष्ट्रपति वलोडिमिर जेलेंस्की ने संकेत दिया है कि वे रूस के साथ एक अस्थायी युद्ध विराम समझौते पर हामी भर सकते हैं। द टेलीग्राफ ने दावा किया है कि जेलेंस्की शांति के लिए रूस को यूक्रेनी क्षेत्र भी देने को तैयार हो गए हैं। इस वक्त पूरी दुनिया के लिए यह खबर सबसे बड़ी है। द टेलीग्राफ की रिपोर्ट के अनुसार ज़ेलेंस्की ने कह दिया है कि "मैं शांति हासिल करने के लिए यूक्रेनी क्षेत्र रूस को छोड़ दूंगा। यूक्रेनी राष्ट्रपति ने पहली बार कहा कि उनका देश 'नाटो की छत्रछाया' में यूक्रेन के कब्जे वाले क्षेत्र को रूस के लिए छोड़ने को तैयार हैं, बशर्ते वह नाटो की सुरक्षा में होना चाहिए। उन्होंने कहा कि नाटो के संरक्षण में यूक्रेन अपने उस क्षेत्र को रूस के लिए अस्थायी रूप से छोड़ सकता है, जो रूस के कब्जे में है। व्लादिमिर ज़ेलेंस्की ने शुक्रवार रात पहली बार कहा कि युद्ध समाप्त करने के लिए वह रूस को अपना क्षेत्र सौंपने को तैयार हैं। जेलेंस्की ने कहा कि किसी भी समझौते में यूक्रेन की अंतरराष्ट्रीय स्तर पर मान्यता प्राप्त सीमाओं को मान्यता देनी होगी। यह सुनिश्चित करना होगा कि कब्जे वाले क्षेत्र सैद्धांतिक रूप से यूक्रेन का हिस्सा बने रहें। जेलेंस्की ने भविष्य में रूसी आक्रमण को रोकने के लिए नाटो समर्थित युद्ध विराम को जरूरी बताया। उन्होंने कहा कि नाटो को तुरंत यूक्रेन के उस हिस्से को कवर करना चाहिए , जो हमारे नियंत्रण में है। ऐसा ना होने पुतिन की सेना फिर से यहां आ जाएगी वापस आ जाएगा।

How G7 and EU are weaponising diamonds and carbon: In the wake of the Ukraine war, the West tried every trick in the diplomatic playbook to get India to loosen ties with Russia. After that strategy failed, it is using trade to force New Delhi's hand,. India polishes 10 out of the 11 rough diamonds the world mines. It is a global monopoly the world envies. Since the West imposed sanctions on Russia following its invasion of Ukraine, the US and Europe have been fuming over India continuing to trade with Moscow, especially in crude oil. Frustratingly, they cannot out of self-interest - stop India from buying Russian crude because Indian refineries ship the finished product, including diesel, to Europe which needs a regular supply of diesel. Indian diamantaries had anyway stopped buying rough diamonds from Russia following Western sanctions, replacing them with roughs bought from the trading division of Anglo-American mining conglomerate De Beers for polishing and export. But the G7's diktat to certify all rough diamonds at Belgium's new traceability centres from September means Indian exporters will have to ship roughs to Brussels before getting them back certified as not being of Russian origin before refining and exporting them. This will add to their overall costs. While the G7's new diamond export rule is aimed at India, the world's largest processor of rough diamonds, the new carbon tax levied by the European Union (EU) is designed to penalise developing countries. Called the Carbon Border Adjustment Mechanism (CBAM), the tax kicks in from 2026. But exporters of steel, cement and other products whose manufacturing process carries a significant carbon footprint have had to submit detailed documentation of their processes every two months starting from October 2023. "US foreign policy has long been suffused with militarism, unilateralism, and hypocrisy. The problem goes far beyond Iraq. Think about Vietnam, Cambodia, Laos, Nicaragua, Serbia (1999), Afghanistan (both 1979 and 2001), Syria (the CIA-led attempt to overthrow Assad), Libya, and Ukraine (Yanukovych's overthrow). "The UN Security Council should be forging a path to peace, one that is based on Ukraine's neutrality. But the UNSC has not even tried to find a negotiated path to peace. source: et

As crude prices rise, should worry about India's strategic oil buffer? India's oil demand is growing amid the global volatility around crude supply and prices. The country has just 75 days of strategic oil buffer, while China, the top oil-importing nation ahead of india, maintains six months of cushion. The country now consumes more than double the petrol it used a decade ago. Its diesel consumption is up by about a third, while the overall oil demand has risen by half, the latest government data shows. This is obviously a sign of a growing economy. But it also has a doomy message for the fisc of a country, which depends heavily on imports to meet its domestic oil demand. For, Brent crude prices are once again moving towards USD90 levels and might hit USD100 per barrel soon. Does India, the world's third-largest oil consumer and importer, have the preparedness to tackle any massive global supply crunch or price rise? Does it have enough strategic reserves for a rainy day? FY24 saw a muted growth in the country's oil and gas production, while the dependency on imports rose. As domestic demand increased, imports went up to 87.7% in the current fiscal till February against 87.2% in FY23, as per the latest data from the government's Petroleum Planning and Analysis Cell. According to the International Energy Agency's (IEA) World Energy Outlook 2022, India's energy consumption will double by 2040, growing at about 3% per annum, compared to the global average growth rate of 1%. The reasons for India's rising energy demand primarily area growing population-soon to be the world's largest and a period of rapid economic growth. The outlook also forecasts that India's share in global energy demand will double to 11% from 6% now the fastest growth in that period for any country. The importance of strategic storage In 2020, the global crude witnessed the biggest fall in 20 years. India took advantage of the depressed prices and filled its caverns at around USD20 per barrel. This was partially used during February-March 2022, when oil prices breached the USD100 per barrel-mark. As oil prices are rising again, a good buffer stock could be useful to partially absorb an abnormal spike in the global oil prices. Today, the Israel-Hamas conflict, the Russia-Ukraine war, and the Red Sea crisis have reinforced the need for India to strategically build its crude oil storage reserves. source: et

Small cut in the fuel price a big hit to OMC revenue: Analysts Earnings may fall by Rs 30kcer due to March 15 decision to slash petrol, diesel prices by Rs 2, say analysts. This is the first fuel revision by the OMCs in nearly two years-the last was on April 6, 2022. Despite major volatility in global oil prices due to the Russia-Ukraine war and unrest in West Asia, India pump prices have remained steady. The price cut of Rs 2 per litre for petrol and diesel by the state-run oil marketing companies (OMCs)--Indian Oil Corp. (IOCL), Hindustan Petroleum Corp. (HPCL) and Bharat Petroleum Corp. (BPCL)--will erode their revenue and ebitda, according to analysts. The government had announced the price cut with effect from March 15, a day before general election dates were announced. "Although small on headline, a Rs 2 per litre cut will reduce OMC revenue/ebitda by about Rs 30,000 crore ($3.7bn) annualised," JP Morgan said in March 15 report, adding that "the latest data suggests Russian crude discounts have fallen further. Put together, these should remove the current super-normal profitability at the three companies." A senior OMC official said the companies are hoping the fuel price cut is effective only for the next three months and that crude does not turn too volatile. Oil prices hovered near a fourmonth high at $85 a barrel, on Friday after the International Energy Agency (IEA) revised its 2024 oil demand forecast higher. IEA said world oil demand will rise by 1.3 million barrels per day (bpd) in 2024, up 110,000 bpd from last month. In a report, Motilal Oswal said since there is no indication of any excise duty relief from the central government, it appears that the price cut will be borne entirely by the OMCs. They are currently pricing in net marketing margins of Rs 1.7-2.7 per litre. The price cut implies that net marketing margins will decline to Rs 0.8-0.9 per litre. "We estimate every `0.5 per litre cut to net marketing margin would reduce FY25E Ebitda for HPCL/BPCL/IOCL by 16%/13%/11%, respectively," Goldman Sachs said in a March 15 report. "In the near term, OMCs will mark down retail fuel inventories and partly negate the inventory gain from higher crude for F24," Morgan Stanley said in its report. source: et

Climate change turning adverse to rice crops: Climatic conditions turning adverse to rice crops in parts of Pakistan and China. Then came the issue of accessibility of ports due to the Ukraine war. It led to a sudden rise in the price of rice and some other agri commodities. Then came the reaction of the government, ban on exports of select quality and segment of rice. Will this bring an opportunity for rice exporting companies of India and also the retail investors? If one looks at bottomline branded rice sellers, it has been better than expected. However the agri sector is not very stocks have a recommendation, probably because they are largely small and mid-cap in nature. Important issue is whether retail investors should look at these stocks as tactical plays or as long term investment. To understand whether the up trend would be sustained or not. climatic changes are concerned, they keep happening in different parts of the world and impact different crops. The current wave of rising prices brings in a mixture of head and tailwinds. Companies which are exporting rice and that too branded are likely to stay a healthier bottomline. A key thing to watch would be whether there is any increase in institutional shareholding in these stocks in coming months. if that is the case then would lead to a kind of re-rating in long term. Rice sector stocks - Upside potential Oct 6, 2023 Company Name KRBL Avg Score 8 Reco Analyst Count 1 12.1 Upside Potential% Market Cap Rs Cr Inst Stake% 2.7 Market Cap Type Mid 9,031 LT Foods Company Name Avg Score 9 Reco LT Foods Limited is a consumer food company. The Company operates through the manufacture and storage of rice segment. Chaman Lal Setia Exports Limited is a company which is engaged in the business of milling and processing of basmati rice. Kohinoor Foods Limited is a company that is engaged in the business of manufacturing, trading, and marketing food products. source:et

USD100 billion, big-ticket FDIs;Canada with India: The ongoing diplomatic crisis between India and Canada can have a full-blown economic impact. Over the years, Canadian investors and pension funds have invested billions of dollars in Indian stock and debt markets, and in key sectors like infra, green energy, tech, and financial services. There are also deep cultural, people-to-people, and educational ties which could be hit. Diplomatic ties, at stake are big-ticket foreign direct investments (FDIs) from Canada, trade relations worth billions of dollars, friendly people-to-people contact, and much more. Nearly 600 Canadian companies, including the big ones such as Bombardier and SNC Lavalin, have presence in India. The top Indian entities where Canadian firms have investments include ICICI Bank, Kotak Mahindra Bank, Paytm, Zomato, Nykaa, Delhivery, Wipro, and Infosys. Bilateral trade between the two countries had risen in 2022 despite the shadow of the pandemic and the disruptions caused by the war in Ukraine. Invest India, an India government-led organisation aimed at giving a fillip to investments in India on its main Canada page has a big photo of Justin Trudeau and Narendra Modi saying “India-Canada: Natural allies and partners towards growth”. Canada and India have been working toward a Comprehensive Economic Partnership Agreement and a Foreign Investment Promotion and Protection Agreement (FIPA/ BIPPA). Farwa Aamer, director of South Asia initiatives at the Asia Society Policy Institute in New York, says, "The Canada-India relationship finds itself at a critical juncture, characterised by a web of escalating tensions and uncertainties. source:et

Nov 30 2024, 14:56

- Whatsapp

- Facebook

- Linkedin

- Google Plus

0