सरकार ने कुछ एम एंड ए सौदों को सीसीआई अनुमोदन आवश्यकता से छूट देने का प्रस्ताव किया है: कॉरपोरेट मामलों के मंत्रालय द्वारा भारतीय प्रतिस्पर्धा आयोग (सीसीआई) की मंजूरी आवश्यकता से संयोजनों की कुछ श्रेणियों को छूट देने के लिए मसौदा नियम जारी किए गए हैं। जेएसए एडवोकेट्स एंड सॉलिसिटर्स में प्रतिस्पर्धा कानून के पार्टनर और प्रमुख वैभव चौकसे ने कहा कि मसौदा नियमों में कुछ प्रकार के एम एंड ए (विलय और अधिग्रहण) लेनदेन को शामिल किया गया है, जिन्हें सीसीआई से अनुमोदन की आवश्यकता नहीं होगी। सरकार ने इंट्रा-ग्रुप लेनदेन और कुछ अन्य विलय और अधिग्रहणों को प्रतिस्पर्धा आयोग की मंजूरी की आवश्यकता से छूट देने का प्रस्ताव दिया है, एक ऐसा कदम जिससे निगरानी पर नियामक बोझ को कम करने में मदद मिलने की संभावना है। कॉरपोरेट मामलों के मंत्रालय द्वारा भारतीय प्रतिस्पर्धा आयोग (सीसीआई) की मंजूरी आवश्यकता से संयोजनों की कुछ श्रेणियों को छूट देने के लिए मसौदा नियम जारी किए गए हैं। जेएसए एडवोकेट्स एंड सॉलिसिटर्स में प्रतिस्पर्धा कानून के पार्टनर और प्रमुख वैभव चौकसे ने कहा कि मसौदा नियमों में कुछ प्रकार के एम एंड ए (विलय और अधिग्रहण) लेनदेन को शामिल किया गया है, जिन्हें सीसीआई से अनुमोदन की आवश्यकता नहीं होगी। उन्होंने कहा कि इनमें इंट्रा-ग्रुप लेनदेन, कुछ प्रकार के अल्पसंख्यक और बढ़ते अधिग्रहण और राइट्स इश्यू शामिल हैं क्योंकि इनका बाजार में प्रतिस्पर्धा पर कोई प्रभाव नहीं पड़ेगा। उनके अनुसार, नियम एम एंड ए लेनदेन की छूट वाली मौजूदा श्रेणियों को प्रतिस्थापित और संशोधित करेंगे। नियम एम एंड ए लेनदेन के पक्षों के बीच ओवरलैप को मैप करने के लिए आवश्यक संबद्ध परीक्षण को भी संशोधित करते हैं। source:et

टाटा संस ने टीसीएस का 9,300 करोड़ रुपये का हिस्सा बेचने की योजना बनाई है: टाटा संस टाटा समूह की होल्डिंग कंपनी के रूप में कार्य करती है: TCS में टाटा संस की 72.38% हिस्सेदारी थी। सोमवार को बीएसई पर स्टॉक 1.75% फिसलकर 4,144.75 पर पहुंच गया। टीसीएस का बाजार पूंजीकरण ₹15 लाख करोड़ के ठीक उत्तर में है, जो टाटा समूह की सभी सूचीबद्ध कंपनियों के कुल बाजार मूल्य ₹31.09 लाख करोड़ का लगभग आधा है। टाटा कंसल्टेंसी सर्विसेज (टीसीएस) की होल्डिंग कंपनी टाटा संस ने मंगलवार को भारत के सबसे बड़े सॉफ्टवेयर सेवा निर्यातक में 23.4 मिलियन शेयर कम से कम ₹9,300 करोड़ में बेचने की योजना बनाई है, जैसा कि सौदे के बैंकर जेपी मॉर्गन द्वारा जारी एक टर्म शीट में दिखाया गया है। स्टॉक के लिए न्यूनतम मूल्य, जो कि कंपनी के इक्विटी आधार का 0.65% है, ₹4,001 प्रत्येक पर निर्धारित किया गया है, जो सोमवार के समापन मूल्य पर 3.6% की छूट दर्शाता है। मूल्य के हिसाब से देश में दूसरा सबसे बड़ा स्टॉक, पिछले एक साल में बायबैक कार्यक्रम के कारण 30% बढ़ गया है। टाटा समूह 91,000 करोड़ रुपये के निवेश से गुजरात के धोलेरा में देश का पहला सेमीकंडक्टर फैब्रिकेशन प्लांट स्थापित कर रहा है। टाटा 27,000 करोड़ रुपये के निवेश के साथ असम में टाटा सेमीकंडक्टर असेंबली और टेस्ट की आगामी चिप असेंबली और परीक्षण इकाई भी स्थापित कर रहा है। टाटा संस की अगले कुछ वर्षों में टाटा डिजिटल में एक अरब डॉलर और निवेश करने की योजना है। इसने पहले ही न्यू ऐप में 2 बिलियन डॉलर से अधिक का निवेश किया है और पांच साल की अवधि में और पूंजी निवेश के लिए बोर्ड की मंजूरी मिल गई है। टीसीएस ने दिसंबर में 17,000 करोड़ रुपये में 40.9 मिलियन शेयर वापस खरीदे। नवीनतम बायबैक के परिणामस्वरूप, टाटा समूह की सबसे बड़ी कंपनी में प्रवर्तक इकाई की संयुक्त हिस्सेदारी 72.3% से बढ़कर 72.41% हो गई। लिस्टिंग योजनाएँ: अलग से, टाटा संस, जो टाटा कैपिटल का मालिक है, को भारतीय रिजर्व बैंक के नियमों का पालन करने के लिए सितंबर 2025 तक सूचीबद्ध होना आवश्यक है। source:et

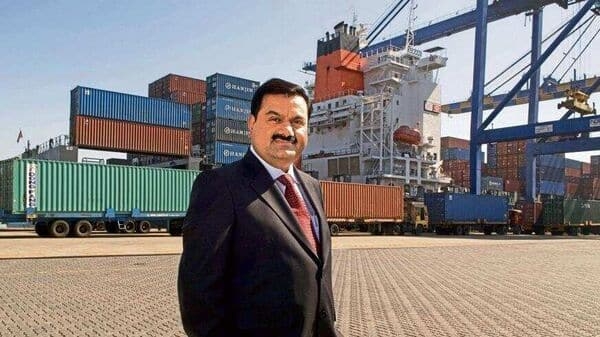

Falling Adani Group stocks keep MFs away. Will Sandeep Tandon's contra bet work?: Sandeep Tandon of Quant Mutual Fund was the biggest buyer of Adani Green Energy in February. The mutual fund bought over 1 million shares of the stock. Across group companies too, Quant MF has acquired 3 million shares, taking its total holding in Adani Group companies to nearly 50 million. Will Quant MF's contrarian stance be proven right? It's "déjà vu all over again" for the Adani Group stocks. The company is in a spot, and this time it's US regulators who want to investigate it for an alleged fraud. The move comes as a major blow at a time when the group's debt had stabilised, and its cash flow had improved. While the Adani Group had been successful in attracting GQG Partners, a foreign institutional investor, to put in USD2.2 billion into the company, most domestic mutual funds are staying away, except one. On March 15, the Adani Group was again in limelight for the wrong reason, just as most group stocks were nearing the pre-Hindenburg highs. According to a Bloomberg news report, the company is being investigated by the US Attorney's Office for the Eastern District of New York and the Justice Department's Fraud Unit in Washington. The probe focuses on the conduct of Adani Green founder, Gautam Adani, and investigates whether the company or Adani may have engaged in bribery. It alleges Adani Group paying officials in India for favourable treatment on an energy project. There is no further clarity or official confirmation from the US regulator on the same. Meanwhile, Adani Group over the weekend announced its plans to invest USD14 billion in capex for FY25, 40% higher than its estimated investment of USD10 billion. Of this, 70% will be dedicated for building green energy capacity, with the remaining going to airports and ports. But it is still unclear how the company will raise this massive amount. The listed Adani companies (with Adani in prefix) generated cashflow from operating activities of INR50,000 crore in FY23 and around INR31,000 crore in the first half of FY24. The total debt of these companies was INR2.18 lakh crore at September end as opposed to INR2.2 lakh crore in FY23. Since the release of the Hindenburg report, the fundraising activity in Adani Group has been lull. The company did raise US Dollar bond earlier this month for refinancing its debt, which is nearing maturity. Post the cancellation of the follow-on public offer of Adani Enterprises in January last year, fundraising through equity has been limited too. One of the reasons for the company not tapping into equity market could be the lack of interest among investors. Between December 2022 and December 2023, retail investors (share capital up to INR1 lakh) have raised their stake by 4 percentage points in Adani Total Gas and by 2 percentage points in Adani Energy Solutions. Across the rest of the group companies, these investors have raised their stake by just 1 percentage point. The MF play: The mutual funds' stake across group companies has remained flat during the same period, except for Adani Power where the stake has risen by 1 percentage point and Adani Ports and SEZ where they have cut stake by 1 percentage point. In general, mutual funds besides the likes of Quant, which follow a long-term investing strategy, are not investing into the Adani Group. These stocks are high beta (with 1-year beta being 1.4 to 2). While they have rewarded investors with astronomical returns in the past few years, they have also resulted in monumental loses. Post Hindenburg, the group's market capchad more than halved from INR19 lakh crore. With the US probe hinting at lack of corporate governance compliance, investing in Adani Group companies may turn riskier than rewarding in the coming few days. In which case, how will the company raise funds to build assets that generate long-term returns? Perhaps, this is why long-term investors like domestic mutual funds are still not willing to take a bet on Adani Group companies. source: et

GIFT Nifty down 80 points;the trading setup for today's session: The net short of Fils increased from Rs 57,390 crore on Friday to Rs 61,315 crore on Monday. Foreign portfolio investors were net sellers at Rs 2,051 crore on Monday. Domestic institutional investors bought shares worth Rs 2260 crore. Equity markets ended higher in a volatile trade on Monday, but the broader market continued to underperform. Analysts expect the markets to consolidate over the next few days while the broader market may continue to remain subdued. GIFT Nifty on the NSE IX traded lower by 83 points, or 0.37 per cent, at 22,053.50, signaling that Dalal Street was headed for negative start on Tuesday. • Tech View: The short-term trend of Nifty remains positive with range-bound action. A decisive break below the support of 21900-21850 is likely to drag Nifty down to 21500 levels in a quick period of time. Any upside bounce from here could encounter strong hurdles around 22200 levels, Nagaraj Shetti of HDFC Securities said. • India VIX: India VIX, which is a measure of the fear in the markets, rose 1.5% to settle at 13.90 levels. Stocks in F&O ban today 1) ZEE 2) ABFRL 3) Manappuram 4) RBL Bank 5) SAIL 6) Tata Chemicals 7) BHEL 8) Nalco 9) PEL 10) Balrampur Chini Mills 11) Biocon 12) Hindustan Copper Securities in the ban period under the F&O segment include companies in which the security has crossed 95% of the market-wide position limit. source:et

Creditors seek more in Liberty Oil debt auction: Liberty Oil Mills, a cooking oil company, has been engaged in refining and trading edible oils, along with manufacturing clarified butter, vegetable oils, fats, and bakery products. With an annual capacity exceeding 650,000 metric tons and six processing facilities with a strong presence in Western India, according to an India Ratings report. The company started facing cash flow mismatches after the buyer's credit withdrawal as per Reserve Bank of India's guidelines introduced in 2018, and high custom duty payments, according to a court document. Bank of India, a creditor to the bankrupt Liberty Oil Mills, is gearing up for a Swiss auction tied to a binding bid that guarantees 66% recovery of the book value. Phoenix ARC has made a bid of ₹82 crore for the ₹126 crore loan, leading the lender to schedule a Swiss auction on March 22 to explore further bids. The auction, set with a reserve price of ₹82 crore and a minimum markup requirement of 5%, has asked for counter bids starting at ₹86 crore. Spokespersons of both Phoenix ARC and Bank of India did not respond immediately to requests for comment. source:et

Govt proposes exempting certain M&A deals from CCI approval requirement: Draft rules to exempt certain categories of combinations from the Competition Commission of India (CCI) approval requirement have been issued by the corporate affairs ministry. Vaibhav Choukse, Partner & Head - Competition Law at JSA Advocates & Solicitors, said the draft rules enlist certain kinds of M&A (Merger & Acquisition) transactions which will not require approval from the CCI. The government has proposed exempting intra-group transactions and certain other mergers and acquisitions from the requirement of Competition Commission approval, a move that is likely to help in reducing the regulatory burden on the watchdog. Draft rules to exempt certain categories of combinations from the Competition Commission of India (CCI) approval requirement have been issued by the corporate affairs ministry. Vaibhav Choukse, Partner & Head - Competition Law at JSA Advocates & Solicitors, said the draft rules enlist certain kinds of M&A (Merger & Acquisition) transactions which will not require approval from the CCI. These include intra-group transactions, certain types of minority and creeping acquisitions, and rights issue as they will not have an impact on the competition in the market, he added. According to him, the rules will replace and modify the existing categories of M&A transactions that are exempt. The rules also modify the affiliate test required to map overlaps between the parties to the M&A transaction. source: et

Tata Sons plans to sell Rs 9,300 crore slice of TCS: Tata Sons serves as the holding company of the Tata Group: Tata Sons held a 72.38% stake in TCS. The stock slid 1.75% to 4,144.75 on the BSE Monday. TCS has a market capitalisation just north of ₹15 lakh crore nearly half the total market value of all the Tata Group listed companies at ₹31.09 lakh crore. Tata Sons, the holding company of Tata Consultancy Services (TCS), plans to sell 23.4 million shares in India's largest software services exporter for at least ₹9,300 crore on Tuesday, showed a term sheet issued by JP Morgan, the banker to the deal. The floor price for the stock, amounting to 0.65% of the company's equity base, has been set at ₹4,001 apiece, representing a discount of 3.6% to Monday's closing price. The stock, the second-biggest by value in the country, has surged 30% in the past one year, underpinned by a buyback programme. The Tata Group is establishing the country's first semiconductor fabrication plant at Dholera, in Gujarat, with an investment of Rs 91,000 crore. Tata is also setting up Tata Semiconductor Assembly and Test's upcoming chip assembly and testing unit in Assam, with an investment of Rs 27,000 crore. Tata Sons plans to invest another $1 billion in Tata Digital over the next few years. It has already invested more than $2 billion in the Neu app and has board approvals for further capital infusion over a five-year period. TCS bought back 40.9 million shares in December for Rs 17,000 crore. As a result of the latest buyback, the combined shareholding of the promoting entity in the biggest Tata Group company increased to 72.41% from 72.3%. Listing Plans: Separately, Tata Sons, which owns Tata Capital, is required to list by September 2025 to comply with Reserve Bank of India regulations. source:et

चुनाव के बाद आर्थिक बदलाव और नागरिक-राज्य इंटरफ़ेस में आमूल-चूल बदलाव की उम्मीद: मोदी का एजेंडा क्या मोदी को तीसरे कार्यकाल के लिए लौटना चाहिए, जैसा कि व्यापक रूप से अपेक्षित है, उनका संभावित एजेंडा क्या होगा? हाल के दिनों में, भारत सरकार ने अपनी आर्थिक दिशा के बारे में संकेत दिए हैं। जोर विनिर्माण पर है, लेकिन उससे भी ज्यादा जोर आर्थिक बदलाव और नागरिक-राज्य इंटरफेस में बदलाव पर है। जैसे ही 2024 का लोकसभा चुनाव शुरू हो रहा है, भारत के लोकतंत्र में हितधारकों या फैसले के बाद के संभावित एजेंडे के सबूत तलाश रहे लोगों के लिए तीन बिंदु ध्यान देने योग्य हैं। प्रत्येक आगामी लोकसभा प्रतियोगिता संख्यात्मक रिकॉर्ड तोड़ती है। यह एक तार्किक चमत्कार और चुनौती है। क्रमबद्ध तारीखें और एकाधिक दौर अपरिहार्य हैं। 969 मिलियन मतदाताओं के साथ, इस वर्ष यह केवल उत्सुक है। फिर भी, यह निराशाजनक है कि चुनाव गर्मियों में और आगे खिसकता जा रहा है। अप्रैल-मई चुनाव चक्र अटल बिहारी वाजपेयी द्वारा 2004 में बुलाए गए प्रारंभिक चुनाव की विरासत है। उन्होंने त्वरित वसंत चुनाव की गणना की थी। चुनाव आयोग ने इसे गर्मियों की शुरुआत तक बढ़ा दिया था, जिसमें 10 मई को अंतिम मतदान दिवस था। 2024 में अंतिम वोट डाला जाएगा (या) मुक्का मारा) 1 जून को। 20 वर्षों में, हमने चुनाव को तीन सप्ताह आगे बढ़ा दिया है। इस में इस अवधि में, तापमान बढ़ गया है, और प्री-मानसून वर्षा तेजी से अनियमित हो गई है। इस दर पर, 2029 का चुनाव जून में और भी आगे बढ़ जाएगा। यह टिकाऊ नहीं है. 2029 से पहले, ईसी को मई की शुरुआत तक कड़ी रोकथाम की दिशा में काम करना चाहिए। यह सवाल अक्सर पीएम नरेंद्र मोदी के महत्वाकांक्षी लक्ष्य 370 सीटों के बारे में एक आसान तर्क तक सीमित हो जाता है। सच कहूँ तो, इसके लिए गहन मूल्यांकन की आवश्यकता है। कांग्रेस के पतन के बाद से, वास्तव में एक अखिल भारतीय पार्टी का अभाव रहा है। इस पर 3 मार्च को कैबिनेट और मंत्रिपरिषद की दिनभर चली बैठक में मध्यम अवधि की योजनाओं और लक्ष्यों के साथ-साथ 2047 के समग्र दृष्टिकोण पर चर्चा की गई। मोदी ने तब से सार्वजनिक संबोधनों में और झलकियां पेश की हैं। हालाँकि, नीति शब्दों से अधिक बोलती है। अपने अंतिम दिनों में मोदी सरकार की उन्मत्त गति पर विचार करें: • तीन सेमीकंडक्टर परियोजनाओं के लिए मंजूरी को आगे बढ़ाया गया, उनमें से दो में अग्रणी भारतीय और अंतर्राष्ट्रीय (ताइवानी सहित) कंपनियों की भागीदारी शामिल थी। आने वाली एफडीआई के लिए एक असामान्य अनिवार्य प्रतिबद्धता के साथ, यूरोपीय मुक्त व्यापार संघ (ईएफटीए) के साथ एक व्यापार समझौते पर हस्ताक्षर किए। शर्त यह है कि इस निवेश का कम से कम कुछ हिस्सा - नॉर्वे और स्विट्जरलैंड से - भारत की तकनीकी और हरित विनिर्माण महत्वाकांक्षाओं को सक्षम करेगा। • पिछले सप्ताह के अंत तक बातचीत के साथ, ब्रिटेन के साथ एक एफटीए संपन्न करने की पुरजोर कोशिश की गई। एक नई ईवी नीति की घोषणा की जो ईवी क्रांति और अंतरराष्ट्रीय कंपनियों के लिए भारत को विनिर्माण और निर्यात केंद्र बनाने के द्वार खोलती है। संक्षेप में, मोदी सरकार ने एक संकेत भेजा है कि तीसरे कार्यकाल में वह एक अंशांकित, विविधीकृत और लचीले वैश्वीकरण के लिए तैयार है, जो राष्ट्रीय क्षमताओं के निर्माण के लिए भारत के दृढ़ संकल्प को पूरा करता है और संबोधित करता है - और जिसमें राष्ट्रीय के बीच निष्पक्ष और न्यायसंगत प्रतिस्पर्धा की गुंजाइश है। चैंपियन और वैश्विक दिग्गज। यही मोदी की, भारत की और 2024 की आशा और आकांक्षा है। source:et

क्रेडिट लाइफ पॉलिसियों में 30% कमीशन कैप की संभावना: मामले की जानकारी रखने वाले लोगों ने कहा कि जीवन बीमा कंपनियां क्रेडिट जीवन पॉलिसियों के लिए बैंकों और गैर-बैंकिंग वित्तीय कंपनियों सहित कॉर्पोरेट एजेंसियों को दिए जाने वाले कमीशन पर 30% की सीमा लगाने पर सहमत होने के करीब हैं। मामले की जानकारी रखने वाले लोगों ने कहा कि जीवन बीमा कंपनियां क्रेडिट जीवन पॉलिसियों के लिए बैंकों और गैर-बैंकिंग वित्तीय कंपनियों सहित कॉर्पोरेट एजेंसियों को दिए जाने वाले कमीशन पर 30% की सीमा लगाने पर सहमत होने के करीब हैं। ऐसा तब हुआ है जब उद्योग ने जीएसटी चोरी के आरोपों का सामना करने वाले बीमाकर्ताओं के मद्देनजर उत्पाद-वार सीमा को खत्म करने और कंपनी-वार सीमा को अपनाने के नियामक के फैसले के बाद विपणन प्रथाओं को फिर से बदल दिया है। इस मामले की जानकारी रखने वाले दो लोगों ने बताया कि पिछले कुछ महीनों में जीवन बीमा परिषद की बैठकों में इस मामले पर चर्चा हुई है। उन्होंने कहा, हालांकि परिषद ने अभी तक कोई औपचारिक पत्र नहीं भेजा है, लेकिन स्व-नियमन लागू करने के लिए बातचीत उन्नत चरण में है। बीमाकर्ताओं और बैंकों या हाउसिंग फाइनेंस कंपनियों के बीच कुछ साझेदारियों में, जहां 21 करोड़ का आवास ऋण समान राशि की पॉलिसी राशि के बराबर होता है, वहां प्रीमियम मार्च तक 5% से बढ़कर 35% हो गया है। क्रेडिट जीवन बीमा एक प्रकार का जीवन बीमा है जिसे ऋण चुकाने में मदद करने के लिए डिज़ाइन किया गया है यदि बीमाधारक व्यक्ति ऋण पूरी तरह चुकाने से पहले ही मर जाता है। हालाँकि यह पॉलिसी वैकल्पिक है, यदि इसे चुना जाता है, तो इसकी लागत ऋण की मूल राशि में जोड़ दी जाती है। नाम न छापने की शर्त पर एक जीवन बीमा अधिकारी ने कहा, "अब, उधारकर्ताओं पर अनुचित बोझ को रोकने के लिए कमीशन को 30% तक सीमित करने पर चर्चा चल रही है।" "नियामक ने दिशानिर्देश जारी करते समय बीमा पॉलिसियों और संबंधित कमीशन पर उपभोक्ताओं के हितों की रक्षा के बारे में बात की थी। इसलिए, हालांकि नियामक नियम-आधारित दृष्टिकोण से मूलधन-आधारित दृष्टिकोण की ओर बढ़ गया है, लेकिन वह हस्तक्षेप नहीं कर सकता है, लेकिन उम्मीद कर सकता है कि उद्योग खुद को लागू करेगा। -अनुशासन,'' एक मध्यम आकार की बीमा कंपनी के सीईओ ने नाम न छापने की शर्त पर कहा। source: et

Mar 19 2024, 09:55

- Whatsapp

- Facebook

- Linkedin

- Google Plus

0