Top Nifty50 stocks analysts suggest buying this week: Nifty50 were given a "Strong Buy/Buy” recommendation in the latest Stock Reports dated September 10, 2023. Analysts' recommends using Institutional Brokers' Estimate System (IBES) to provide actionable insights. One can also check the breakdown of the count of analysts' giving buy/sell/hold recommendations to each stock in the index. Simple average of the above-mentioned five component ratings ist normally distributed to reach an average score. Each stock is ranked on a scale of 1 to 10. A score of 8 to 10 is considered positive, 4 to 7 is neutral and 1 to 3 is given a negative outlook. In addition to scores, the report also contains trend analysis, peer analysis and mean analysts' recommendations. We have filtered stocks with an overall positive outlook i.e. an average score of 8-10 for this report. Profitability, debt, earnings quality and dividend trends are evaluated under the fundamentals component in the report. Relative valuation has three components - price to sales (50% weight), trailing P/E (25% weight) and forward P/E (25% weight). These metrics are evaluated against the overall market, index and company's own historic 5-year averages. Risk score evaluates a series of long term (5- year) and short term (90-day) stock performance measures including volatility, magnitude of returns, beta and correlation. Price momentum rating is based on a combination of two technical performance factors: relative strength (70% weight) and seasonality (30% weight). source:et

5 stocks from electrical and mini white goods upside potential of up to 36% What would you call a company which makes both, water geysers and electrical wires, a white goods the year 2015 to 2020, companies with strong brands in different sectors considered as commodity plays got re-rated by the street. With stock prices remaining in a range and earnings moving upward there has been a value readjustment of their valuations. The companies which have higher probability of getting back the mojo are the ones which will build domestic supply chains. These companies have outperformed strong bearish markets as they did not move below a certain price level. After a long phase of consolidation, whether the stocks are ready for another round of upward movement. Consumer durables stocks - Upside potential Sep 25, 2023 Company Name Havells India Avg Score 7 Reco Buy Analyst Count 40 Upside Potential % 36.44 Inst Stake% 20.6 Market Cap Type Large Market Cap Rs Cr 87,261 Company Name Voltas Avg Score 4 Reco Hold Analyst Count 40 Upside Potential% 28.24 source:et

4 insights to kick-start today; featuring Groww vs Zerodha: Groww may pip Zerodha in MAUS; Bajaj Finance's fundraising plans; Amazon to invest in Anthropic; India-Canada tussle. However, recent reports indicate that Groww is nipping at its heels, boasting 6.2 million MAUS in August 2023, just shy of Zerodha's 6.3 million. Sources cited by the Economic Times revealed that in August alone, Groww gained nearly 400,000 MAUS, while Zerodha lagged with a mere 88,000. Although the September figures are yet to come, the ascent of VC- backed Groww is nothing short of remarkable, considering it was founded in 2016, six years after Zerodha. This battle for supremacy is a compelling one, especially given Groww's robust financial backing, having Since Bajaj Finance is well-capitalised with tier-I capital at 23% as of June-end, brokerages believe the company is upfronting the capital raise to support loan growth. Based on the strong June quarter (32% AUM growth), the company guided 29%-31% growth for FY24. Big Tech will remain big tech, not just because of investments they are making in AI companies - Microsoft in OpenAI or Amazon in Anthropic -but also because they control the cloud computing infra, which is critical to making these algorithms do their thing. Interestingly, the Indo-Pacific region is also the hotbed of China's aggressive territorial moves, wherein the allies including India and Canada are working together to maintain a rules-based order. source:et

ग्लेनमार्क ने सहायक कंपनी में हिस्सेदारी बेची;सेमी कंडक्टर्स के लिए अच्छी खबर: ग्लेनमार्क फार्मास्यूटिकल्स ने अपनी सक्रिय फार्मास्युटिकल सामग्री (एपीआई) सहायक कंपनी ग्लेनमार्क लाइफ साइंसेज में 75% हिस्सेदारी निरमा को 5,651.5 करोड़ रुपये में बेचने के लिए समझौते पर हस्ताक्षर किए। ग्लेनमार्क फार्मा 615 रुपये प्रति शेयर के हिसाब से हिस्सेदारी बेच रही है। लेन-देन से ग्लेनमार्क लाइफ साइंसेज में अतिरिक्त 17.15% हिस्सेदारी खरीदने के लिए निरमा की ओर से एक अनिवार्य खुली पेशकश शुरू हो जाएगी। ओपन ऑफर की कीमत 631 रुपये प्रति शेयर है। विनिवेश के बाद 22 सितंबर को ग्लेनमार्क लाइफ साइंसेज के शेयर 644.5 रुपये पर बंद हुए। ग्लेनमार्क लाइफ साइंसेज में ग्लेनमार्क फार्मा की हिस्सेदारी 7.84% होगी। ग्लेनमार्क फार्मा ने अपनी एपीआई का 15% सोर्स किया भारत का इलेक्ट्रॉनिक्स और आईटी मंत्रालय मोहाली में एससीएल द्वारा संचालित सेमीकंडक्टर लैब का आधुनिकीकरण करना चाहता है और बोलियां आमंत्रित करता है। बैंक निफ्टी में एचडीएफसी बैंक का वेटेज 28.2% और निफ्टी में 14.43% है। एचडीएफसी बैंक में भारी गिरावट ने बैंक निफ्टी में तेजी रोक दी, जो पिछले तीन सत्रों में 1800 अंक से अधिक गिर गया। तकनीकी चार्ट पर, बैंक निफ्टी इंडेक्स ब्रेकआउट 42,000 के स्तर से ऊपर है। source:et

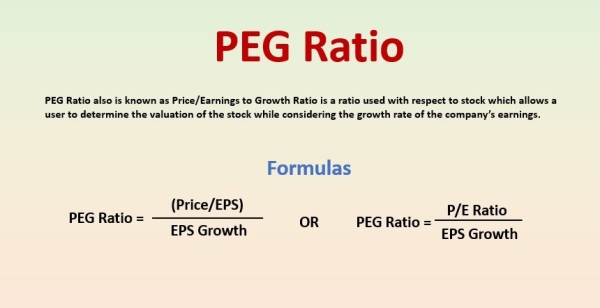

5 stocks with right PEG ratio for long-term wealth creation: The challenge with PEG ratio is the quality of the earning forecast. Given that in an ever changing macro environment , even the best of the forecast for any business can go wrong which may impact other elements which lead to some unexpected changes. But even after all the challenges, it is worth the effort to look at this ratio before investing, especially at times when decisions are being more governed by bullish sentiment than fundamentals. PEG ratio is much better compared to the commonly used P/E ratio. It helps in avoiding stocks which might appear cheap but actually are not value buys. in sectors like banking and financial services which have large numbers of stocks which on face of it appear cheap but are actually not. Also in sectors which are cyclical in nature, it is worth mentioning that calculating the PEG ratio is a complex process and comes with its own set of challenges. It is extremely important to keep this in mind that there are stocks which might start looking attractive due to the low PE ratio as relative valuation would be even higher when one compares on PE basis. Kalpataru Projects International Limited is primarily engaged in the business of EPC relating to infrastructure comprising buildings and factories, power transmission and distribution, roads and bridges, water pipelines, railway track laying and electrification, oil and gas pipelines laying, and other. JSW Steel Limited is a holding company. The Company is engaged in the business of production and distribution of iron and steel products. Shri Ram Finance Limited, formerly Shriram Transport Finance Company Limited, is a company, which is retail non-banking finance company (NBFC). J.K. Cement Limited. is engaged in the manufacturing and selling of cement and cement-related products Route Mobile Limited is a company, which provides communication platform as a service (CPaaS) solutions to enterprises, over-the-top (OTT) players, and mobile network operators (MNO). Stock Reports Plus, powered by Refinitiv, is a comprehensive research report that undertakes an in-depth quantitative analysis of all stocks. source:et

लंबी अवधि में धन सृजन के लिए सही पीईजी अनुपात वाले 5 स्टॉक: पीईजी अनुपात के साथ चुनौती कमाई के पूर्वानुमान की गुणवत्ता है। यह देखते हुए कि लगातार बदलते मैक्रो परिवेश में, किसी भी व्यवसाय के लिए सबसे अच्छा पूर्वानुमान भी गलत हो सकता है जो अन्य तत्वों को प्रभावित कर सकता है जिससे कुछ अप्रत्याशित परिवर्तन हो सकते हैं। लेकिन तमाम चुनौतियों के बाद भी, निवेश करने से पहले इस अनुपात को देखना सार्थक है, खासकर ऐसे समय में जब निर्णय बुनियादी बातों की तुलना में तेजी की भावना से अधिक नियंत्रित हो रहे हों। आमतौर पर इस्तेमाल होने वाले पी/ई अनुपात की तुलना में पीईजी अनुपात काफी बेहतर है। यह उन शेयरों से बचने में मदद करता है जो सस्ते दिख सकते हैं लेकिन वास्तव में मूल्यवान खरीदारी नहीं हैं। बैंकिंग और वित्तीय सेवाओं जैसे क्षेत्रों में बड़ी संख्या में ऐसे स्टॉक हैं जो देखने में सस्ते लगते हैं लेकिन वास्तव में सस्ते नहीं हैं। इसके अलावा उन क्षेत्रों में जो प्रकृति में चक्रीय हैं, यह उल्लेखनीय है कि पीईजी अनुपात की गणना एक जटिल प्रक्रिया है और यह अपनी चुनौतियों के साथ आती है। यह ध्यान में रखना बेहद जरूरी है कि ऐसे स्टॉक हैं जो कम पीई अनुपात के कारण आकर्षक लगने लग सकते हैं क्योंकि पीई के आधार पर तुलना करने पर सापेक्ष मूल्यांकन और भी अधिक होगा। कल्पतरु प्रोजेक्ट्स इंटरनेशनल लिमिटेड मुख्य रूप से इमारतों और कारखानों, बिजली पारेषण और वितरण, सड़कों और पुलों, पानी की पाइपलाइनों, रेलवे ट्रैक बिछाने और विद्युतीकरण, तेल और गैस पाइपलाइन बिछाने और अन्य सहित बुनियादी ढांचे से संबंधित ईपीसी के व्यवसाय में लगी हुई है। जेएसडब्ल्यू स्टील लिमिटेड एक होल्डिंग कंपनी है। कंपनी लौह और इस्पात उत्पादों के उत्पादन और वितरण के व्यवसाय में लगी हुई है। श्री राम फाइनेंस लिमिटेड, पूर्व में श्रीराम ट्रांसपोर्ट फाइनेंस कंपनी लिमिटेड, एक कंपनी है, जो खुदरा गैर-बैंकिंग वित्त कंपनी (एनबीएफसी) है। जे.के. सीमेंट लिमिटेड. सीमेंट और सीमेंट से संबंधित उत्पादों के निर्माण और बिक्री में लगी हुई है रूट मोबाइल लिमिटेड एक कंपनी है, जो उद्यमों, ओवर-द-टॉप (ओटीटी) खिलाड़ियों और मोबाइल नेटवर्क ऑपरेटरों (एमएनओ) को एक सेवा (सीपीएएएस) समाधान के रूप में संचार मंच प्रदान करती है। रिफाइनिटिव द्वारा संचालित स्टॉक रिपोर्ट्स प्लस, एक व्यापक शोध रिपोर्ट है जो सभी शेयरों का गहन मात्रात्मक विश्लेषण करती है। source:et

Glenmark sells stake in subsidiary; Good news for semiconductors: Glenmark Pharmaceuticals signs agreement to divest 75% stake in its active pharmaceutical ingredients (API) subsidiary Glenmark Life Sciences to Nirma for INR5,651.5 crore. Glenmark Pharma is selling the stake at INR615 per share. The transaction will trigger a mandatory open offer from Nirma for additional 17.15% stake buy in Glenmark Life Sciences. The price for the open offer is INR631 per share. On September 22, shares of Glenmark Life Sciences closed at INR644.5 Post the divestment, Glenmark Pharma's stake in Glenmark Life Sciences will be 7.84%. Glenmark Pharma sourced 15% of its API India's Ministry of Electronics and IT is looking to modernise the Semiconductor Lab run by SCL in Mohali and invites bids. The language of price. The weightage of HDFC Bank in Bank Nifty is 28.2% and in Nifty it is 14.43%. The sharp fall in HDFC Bank paused the rally in Bank Nifty which fell more than 1800 points in the last three sessions. On technical charts, the Bank Nifty index breakout is above 42,000 levels. source:er

Go first will fly again?US space allowing to operate: India's second largest low- cost airline, Go First, used to hold weekly reviews led by its promoter Nusli Wadia or chairman Varun Berry. Some management executives got so tired of these 'gruelling sessions' that they requested Go First's CEO Kaushik Khona to space them out. "The assumption was that they were allowing us space to operate," says the official quoted above. A few weeks later, the 2005- founded airline shocked both its employees and the aviation Nearly INR400 crore has been spent by a State Bank of India-led consortium since 2019 to keep Jet Airways, which has only a dozen grounded planes and a few staff, operational as a company. This means that if Go First is not quickly towed back onto the runway from the current mess, or the matter drags on for four years like in the case of Jet Airways, the taxpayer-funded banks will end up paying around INR3,000 crore as things stand today. This does not include the aircraft lease "Lessors say forget the law, think about our financials. But what about allowing the airline to restart? It can't be an IndiGo-Air India duopoly," says the person tracking the bankruptcy process closely. The airline is also reassuring the investors that it has filed an arbitration case seeking USD1.2 billion against Pratt & Whitney for providing faulty engines source:et

50% rally in 3 months!PSU bank is likely to hit fresh record high: The stock rose from Rs 281 as of June 21, 2023, to Rs 427.95, which is also the 52-week high recorded on September 21, 2023, translating into an upside of about 50%. The stock rose from Rs 281 as of June 21, 2023, to Rs 427.95, which is also the 52-week high recorded on September 21, 2023, translating into an upside of about 50%. Short-term traders who want to play the momentum can look to buy the stock for a target of Rs 436 in the next 2-3 weeks, suggest experts. source:et

Sep 26 2023, 09:49

- Whatsapp

- Facebook

- Linkedin

- Google Plus

0