Centre’s clear message via IT hardware PLI 2.0 for Dell, HP, Acer etc; The Centre is clear on the messaging through the revamped IT hardware PLI 2.0. The scheme will be a game changer in not only increasing local manufacturing but also creating the much needed components ecosystem. However, premium products will take longer to be made locally. Approximately, 60 companies including HP, Dell, Acer, Asus, Dixon Technologies, Foxconn have applied for PLI 2.0, which focuses on IT hardware including laptops, desktops, tablets, and servers. They have proposed investments of INR4,000 crore for additional hardware production of INR3.35 lakh crore over six years. Kunal Chaudhary, partner — indirect tax, EY India says, “The applicants represent approximately 90% of the market. The participation level has been really high from most of the large brands.” As per the IT hardware PLI 2.0 scheme, an average incentive of 5% will be provided by the government on net incremental sales over the base year, of goods manufactured in India, compared to 2% earlier. The recent decision to curb free imports of laptops, desktops, and tablets also made global companies take advantage of PLI 2.0 sops to scale their manufacturing play in India. Satya Gupta, CEO, EPIC Foundation (a Bengaluru-based non-profit, working to increase local electronics production) says, “There’s a baseline incentive (3%) given to anybody in the first year, which will increase if they do local value addition and decrease if they don’t. This will certainly motivate participants to do more in India.” the total IT hardware market will be INR3,40,000 crore or approx. USD40 billion. The government expects at least 75,000 new direct jobs will be created due to PLI 2.0 and including indirect and temporary jobs the number will be over 200,000 over the next six years. “That’s big and with incentives tied to components, it’s a win-win situation for India,” adds Gupta. source:et

Kick-start your day, featuring Johnson & Johnson’s big decision: Johnson & Johnson’s big decision; Funds eye Manipal; Emami buys Axiom stake; and auto index shines. Johnson & Johnson will not enforce its patent claims on Sirturo (bedaquiline), a TB drug, in 134 low-and-middle-income countries. The decision comes as a huge relief for TB patients. Bedaquiline is a drug seen as a last resort, or when all available drugs have failed to control TB, or in cases of multidrug-resistant TB. The other such drug is Otsuka’s Delamanid. J&J suffered a setback earlier this year when the patent office dismissed its secondary application for a patent extension. Singapore’s sovereign fund Temasek, which bought an additional stake in Manipal Health in April and became a majority stakeholder, is in talks with sovereign funds, including Abu Dhabi’s Mubadala Investment Co. and Brunei Investment Agency to pare some of its stake in a bid to de-risk its holdings. Mubadala has invested USD4 billion in India, including investments in Mukesh Ambani's telecom and retail businesses and Tata Power's renewable energy unit. Kolkata-based personal and health care company Emami acquired 26% of Haryana-based Axiom Ayurveda for an undisclosed amount. The Nifty rose nearly 20% in the last six months, the Nifty Auto index recorded 40% returns. Index heavyweights Mahindra & Mahindra (18.68%) and Maruti (18.21%) are already at record highs, helping the index to scale new. source:et

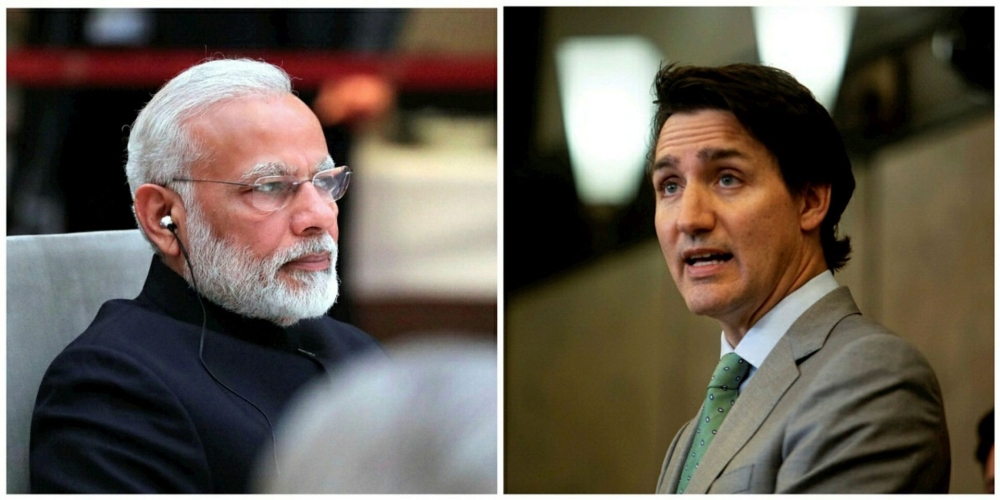

USD100 billion, big-ticket FDIs;Canada with India: The ongoing diplomatic crisis between India and Canada can have a full-blown economic impact. Over the years, Canadian investors and pension funds have invested billions of dollars in Indian stock and debt markets, and in key sectors like infra, green energy, tech, and financial services. There are also deep cultural, people-to-people, and educational ties which could be hit. Diplomatic ties, at stake are big-ticket foreign direct investments (FDIs) from Canada, trade relations worth billions of dollars, friendly people-to-people contact, and much more. Nearly 600 Canadian companies, including the big ones such as Bombardier and SNC Lavalin, have presence in India. The top Indian entities where Canadian firms have investments include ICICI Bank, Kotak Mahindra Bank, Paytm, Zomato, Nykaa, Delhivery, Wipro, and Infosys. Bilateral trade between the two countries had risen in 2022 despite the shadow of the pandemic and the disruptions caused by the war in Ukraine. Invest India, an India government-led organisation aimed at giving a fillip to investments in India on its main Canada page has a big photo of Justin Trudeau and Narendra Modi saying “India-Canada: Natural allies and partners towards growth”. Canada and India have been working toward a Comprehensive Economic Partnership Agreement and a Foreign Investment Promotion and Protection Agreement (FIPA/ BIPPA). Farwa Aamer, director of South Asia initiatives at the Asia Society Policy Institute in New York, says, "The Canada-India relationship finds itself at a critical juncture, characterised by a web of escalating tensions and uncertainties. source:et

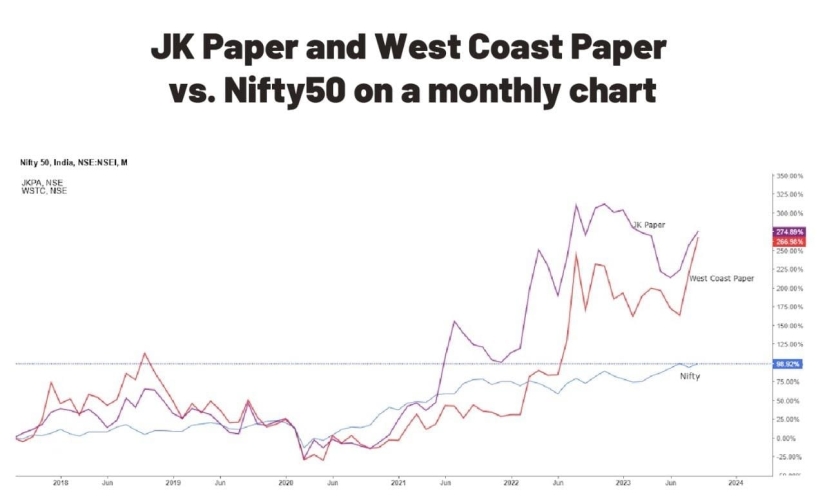

Multibagger paper stocks hinge on demand, prices and the demise of plastic: West Coast Paper, Andhra Paper, JK Paper, Seshasayee Paper and Boards, Orient Paper and Pudumjee Paper — all have posted multibagger returns in the last three years. the replacement of plastic is just one big driver of demand for paper. There are other new avenues opening up for this industry which was taken for dead during the pandemic years. West Coast Paper, Andhra Paper, JK Paper, Seshasayee Paper and Boards, Orient Paper and Pudumjee Paper — all have posted multibagger returns in the last three years. than 500% return. The digitalisation gave way to e-commerce. People were ordering online and that gave fillip to the demand for packaging material. This was a different material for these companies. As the economy started to open and markets went up, investors were initially not convinced about the paper companies. The biggest concern for investors was the source of raw material. Ashok Kumar, executive director, Pudumjee Paper Products says, “The raw material for wood-based mills has changed from predominantly bamboo to hardwoods. The mills based on agri-residues now make use of bagasse and wheat straws to produce some paper products almost similar to wood-based mills in terms of quality. it is difficult for Indian paper mills to have manufacturing capacity similar to the international level when compared to Indonesia, China or many South American and European mills. it is difficult for Indian paper mills to have manufacturing capacity similar to the international level when compared to Indonesia, China or many South American and European paper Mills. source:et

Imports of pulses in India,will it affect market? India imports a significant chunk of its pulses, especially masur arhar/tur (pigeon-pea) from countries including Indonesia, Canada, and Australia. Canada accounted for around 80% of imported masur, followed by Australia in FY22, according to the government data. The contribution declined to nearly 60% in the following year. Masur imports from Canada were 9.09 lt in FY21, 5.23 lt in FY22 and 4.85 lt in FY23. India’s annual consumption of masur stands at nearly 24 lt, while it domestically produces between 12-16 lt. In 2023, the production in Canada fell to 12 lt, while Australia, where the harvest begins in November, is expected to harvest 13 lt. Traders say that India can also look at diversifying its imports of pulses, especially masur, and can even look at Australia. “India has already doubled its lentil imports from Australia by 2 lt and is also importing from Russia. There is a general agreement among experts and stakeholders that Canada wouldn’t stretch the tussle for long, seeing the latest statement made by Justin Trudeau. source:et

अल्ट्राटेक कॉर्बन डाइऑक्साइड उत्सर्जित करने वाले ग्लोबल कंपनी: विशेषज्ञों का मानना है कि स्पष्ट खरीद नीति के अभाव और देश में कम कार्बन या हरित सीमेंट की स्पष्ट परिभाषा के अभाव में मिश्रित सीमेंट बाजार को आगे बढ़ने में समय लगेगा। चीन के बाद भारत दुनिया का सबसे बड़ा सीमेंट उत्पादक है। विश्व स्तर पर, सीमेंट उद्योग CO2 के शीर्ष औद्योगिक उत्सर्जकों में से एक है। जबकि भारतीय सीमेंट कंपनियां मिश्रित सीमेंट, नवीकरणीय ऊर्जा और उन्नत प्रौद्योगिकियों के साथ अपने कार्बन पदचिह्न को कम करने की कोशिश कर रही हैं, उच्च उत्पादन लागत, कमजोर मांग और सब्सिडी की कमी इस क्षेत्र की हरियाली में बाधा बन रही है। भारत के सबसे बड़े सीमेंट उत्पादक, अल्ट्राटेक ने अपने सीमेंट संयंत्र में उपयोग के लिए 57,000 मीट्रिक टन (लगभग 1,000 ट्रक लोड) औद्योगिक कचरे का पुनर्उपयोग करने का निर्णय लिया। कंपनी के अध्यक्ष, अल्ट्राटेक, कुमार मंगलम बिड़ला ने कहा, "इसे ओडिशा के पारादीप बंदरगाह से गुजरात के अमरेली जिले के कोवाया में अल्ट्राटेक के घाट पर सुरक्षित रूप से ले जाया गया।" अंतर्राष्ट्रीय ऊर्जा एजेंसी (IEA) के अनुमान के अनुसार, भारत का सीमेंट उद्योग विश्व औसत की तुलना में तेज़ दर से बढ़ रहा है। अल्ट्राटेक, जिसने वित्त वर्ष 2013 में 100 मिलियन टन सीमेंट बेचा, वित्त वर्ष 2012 से 12% अधिक, 2050 तक कार्बन न्यूट्रल होने के लिए प्रतिबद्ध है। डालमिया पहली सीमेंट कंपनी है जिसने पारंपरिक ओपीसी (साधारण पोर्टलैंड सीमेंट), एक उच्च कार्बन-उत्सर्जन उत्पाद, को बदलने के लिए एलसी 3 (चूना पत्थर कैलक्लाइंड क्ले सीमेंट) जैसे मिश्रित सीमेंट का तकनीकी परीक्षण किया है, जिससे कार्बन पदचिह्न लगभग 60% कम हो गया है। विशेषज्ञों का मानना है कि स्पष्ट खरीद नीति के अभाव और देश में कम कार्बन या हरित सीमेंट की स्पष्ट परिभाषा के अभाव में मिश्रित सीमेंट बाजार को आगे बढ़ने में समय लगेगा। source et

7 pharma stocks with an upside potential up to 31 %: Tailwinds,a company which has a strong domestic brand in the generic drugs segment, will not be getting impacted by what is happening in the US pharma market or what USFDA does. But yes, if it might be impacted by what happens in China. Some companies did come up in limelight during covid, but then post covid they again have lost their shine.Now there’s a change. Last week, when the whole of the market was under pressure, with Nifty closing with a loss, Nifty pharma index was able to log in gains. Companies dealing only in Indian markets, right from ever increasing competition and high selling and promotional expenses is something they have to deal with every day. For large pharma companies whose fortunes are tied up with pricing trends in US markets, there is finally some good news. The shortages in the US market have led to prices of generic drugs moving upward. Companies with a target upside potential of up to 34 percent from the pharma sector. Pharma Stocks - Upside Potential Sep 30, 2023 MISSING: summary MISSING: current-rows. Company Name Avg Score Reco Analyst Count Upside Potential % Inst Stake % Market Cap Type Market Cap Rs Cr Alkem Labs 5 Hold 23 34.50 19.6 Large 43,135 Natco Pharma 9 Hold 14 29.43 21.7 Mid 15,641 Zydus Lifesciences 10 Hold 31 28.62 13.9 Large 62,266 Torrent Pharma 6 Buy 30 25.45 16.2 Large 65,264 Abbott India 7 Buy 9 22.09 7.4 Large 49,211 Dr Reddy's Labs 10 Hold 38 17.42 66.9 Large 93,178 Sun Pharma 8 Buy 37 13.93 26.0 Large 278,107 Calculated from highest price target given by analysts Alkem Laboratories Limited is a pharmaceutical company. The Company is engaged in the development, manufacture and sale of pharmaceutical and nutraceutical products. Natco Pharma Limited is a vertically integrated, research and development (R&D)-focused pharmaceutical company. Zydus Lifesciences Ltd., formerly Cadila Healthcare Limited, is a life sciences company. Torrent Pharmaceuticals Limited is engaged in research, development, manufacturing and marketing of generic pharmaceutical formulations. source:et

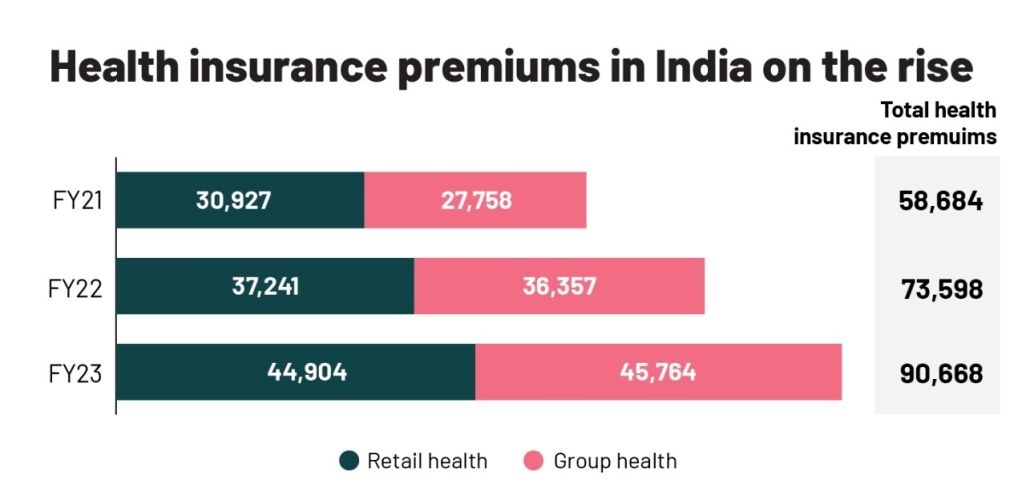

The role of IRDAI on fraudulent practices by hospitals:

Health insurance major Star Health put around 100 hospitals in excluded providers’ list in Ahmedabad after it found their involvement in fraudulent practices. This irked Ahmedabad’s prominent hospital association that threatened to discontinue the cashless claim facility.

The clash between insurance companies and hospitals is back.

Here’s what IRDAI is doing to solve such relapsing tiffs. Once you enter a hospital as a patient, you will be asked to disclose if you have any health insurance policy and whether it is cashless.

For years, there has been a constant tiff between insurance companies and hospitals, and between customers and insurance companies.

Health insurance penetration in India, including public and private insurance, is low at around 40%. Over the past few years, health insurance coverage has been improving but it got a boost during the Covid-19 pandemic.

Health insurance premiums have risen significantly in the last three years and its overall share in the non-life insurance premium segment has increased to 35.3% in FY23 from 29.5% in FY21, as per data from regulatory bodies. regulatory bodies.

source:et

Ultratech the emitters of CO2 going ahead: India is the world’s largest cement producer after China. Globally, the cement industry is among the top industrial emitters of CO2. While Indian cement companies are looking to reduce their carbon footprint with blended cement, renewable power, and advanced technologies, high production costs, weak demand, and lack of subsidies pose hurdles to greening of the sector. India’s biggest cement producer, UltraTech,decided to repurpose 57,000 metric tonne (around 1,000 truckloads) industrial waste to be utilised in its cement plant. “It was safely moved from the Paradip port in Odisha to UltraTech’s jetty in the Amreli district’s Kovaya in Gujarat,” Kumar Mangalam Birla, chairman,UltraTech, said in the company’. According to the International Energy Agency’s (IEA) estimates, India’s cement industry is seen expanding at a faster rate than the world average. UltraTech, which sold 100 million tonnes of cement in FY23, up 12% from FY22, has committed to go carbon neutral by 2050. Dalmia is the first cement company to conduct technical trials of blended cement such as LC3 (limestone calcined clay cement) to replace traditional OPC (ordinary Portland cement), a high carbon-emission product, thereby lowering carbon footprint by almost 60%. Experts believe that it will take time for the blended cement market to take off in the absence of a clear procurement policy and lack of an unambiguous definition of low-carbon or green cement in the country. source:et

Oct 03 2023, 09:12

- Whatsapp

- Facebook

- Linkedin

- Google Plus

0