5 निर्माण और ठेका कंपनियों के पास 30% तक की क्षमता: यह अंतरिम बजट था, एक गिनती पर इसने पूर्ण बजट से भी अधिक संकेत दिए । यह गणना वह मार्ग है जिसका ब्याज दरें अनुसरण कर सकती हैं । यदि कोई ऋण बाजार और बेंचमार्क जी-सेक यील्ड की प्रतिक्रिया से जाता है, तो ब्याज दरों में कमी आने की संभावना बहुत तेजी से बढ़ी है । भारत जैसी अर्थव्यवस्था में, जहां पूंजी की लागत किसी भी चीज़ से अधिक मायने रखती है, कई क्षेत्रों में सकारात्मक प्रभाव दिखाई देगा । जब कंपनियों की बात आती है, तो कुछ ऐसे क्षेत्र होते हैं जिनका ब्याज दरों के साथ मजबूत सह-संबंध होता है । इसका कारण यह है कि उनके उत्पाद और सेवा की मांग और बढ़ने और बेहतर मार्जिन रखने की उनकी अपनी क्षमता दोनों का ब्याज दरों के साथ मजबूत सह-संबंध है । आइए एक नजर डालते हैं कॉन्ट्रैक्टिंग और कंस्ट्रक्शन सेक्टर पर । इस मामले में सड़क हवाई अड्डों और कई अन्य सहित बड़ी बुनियादी ढांचा परियोजनाओं के लिए सरकार की ओर से मांग आती है, और सरकार को उधार लेने पर ब्याज का भुगतान करना पड़ता है, इसलिए जब ब्याज दरें कम होती हैं, तो सरकार के पास बुनियादी ढांचा परियोजनाओं पर खर्च करने के लिए अधिक हेडरूम होता है, जिसका अर्थ है निर्माण और ठेका कंपनियों जबकि कुछ लोग यह तर्क दे सकते हैं कि सरकारें परियोजनाओं पर निर्णय लेते समय ब्याज दरों के प्रति बहुत सचेत नहीं हैं, वास्तव में सरकार है । क्योंकि सरकार से अधिक उधार लेने से अंततः उच्च ब्याज दरें होती हैं और उच्च मुद्रास्फीति एक प्रमुख दुष्प्रभाव है जिसका अर्थ है कि सत्ता खोना जो कोई सरकार नहीं चाहती है । औसत स्कोर पांच प्रमुख स्तंभों यानी कमाई, बुनियादी बातों, सापेक्ष मूल्यांकन, जोखिम और मूल्य गति पर आधारित है । निम्नलिखित 5 निर्माण स्टॉक की स्क्रीनिंग में उपयोग किए गए डेटा को 3 फरवरी, 2024 की नवीनतम रिफिनिटिव स्टॉक रिपोर्ट से एकत्र किया गया है । निर्माण क्षेत्र के शेयरों-उल्टा संभावित 3 फरवरी, 2024 कंपनी का नाम लार्सन एंड टुब्रो औसत स्कोर 10 रेको खरीदें विश्लेषक गणना 34 उल्टा क्षमता % 30.3 आईएनएसटी हिस्सेदारी% 46.6 मार्केट कैप प्रकार बड़ा 1वाई रिटर्न % मार्केट कैप करोड़ रुपये कंपनी का नाम 57.4 474,852 एनसीसी औसत स्कोर 8 रेको खरीदें विश्लेषक गणना 14 उल्टा क्षमता% 20.4 आईएनएसटी हिस्सेदारी % 24.2 मार्केट कैप प्रकार मध्य 1वाई रिटर्न% 132.7 मार्केट कैप करोड़ रुपये 13,511 कंपनी का नाम पीएसपी परियोजनाएं औसत स्कोर 7 रेको मजबूत खरीद विश्लेषक गणना 7 उल्टा क्षमता % 19.3 आईएनएसटी हिस्सेदारी% 7.3 मार्केट कैप प्रकार छोटा 1वाई रिटर्न % 12.0 मार्केट कैप करोड़ रुपये 2,777 कंपनी का नाम अहलूवालिया ठेके औसत स्कोर 8 रेको पकड़ो विश्लेषक गणना 11 उल्टा क्षमता % 6.3 आईएनएसटी हिस्सेदारी% 36.6 मार्केट कैप प्रकार मध्य 1वाई रिटर्न % 78.2 मार्केट कैप करोड़ रुपये 5,794 कंपनी का नाम आईटीडी सीमेंटेशन औसत स्कोर 9 रेको खरीदें विश्लेषक गणना 3 उल्टा क्षमता% 3.6 आईएनएसटी हिस्सेदारी% 5.4 मार्केट कैप प्रकार मध्य 1वाई रिटर्न% 205.6 मार्केट कैप करोड़ रुपये 5,436 विश्लेषकों द्वारा दिए गए उच्चतम मूल्य लक्ष्य से परिकलित source: et

मिडकैप शेयरों में राइट आरओई और 44% तक की अपसाइड क्षमता है: एक बाजार में जहां बैल सड़क के हर कोने पर शासन कर रहे हैं, और स्टॉक या तो काफी मूल्यवान हैं या ओवरवैल्यूड हैं । बड़ा सवाल यह है कि उचित मूल्यांकन पर अच्छी गुणवत्ता वाले शेयरों को खरीदने के बुनियादी पहलू का ध्यान कैसे रखा जाता है । बाजारों में निवेश करते समय गुणवत्ता वाले स्टॉक खरीदना बुनियादी सिद्धांतों में से एक होना चाहिए । लेकिन जब कोई मिड-कैप स्टॉक खरीद रहा होता है तो यह सिद्धांत कई कारणों से और विशेष रूप से ऐसे समय में और भी महत्वपूर्ण हो जाता है जब वैल्यूएशन सस्ते नहीं होते हैं और छोटे सुधार से स्टॉक की कीमतों में मजबूत नकारात्मक प्रतिक्रिया हो सकती है । अब कोई इसे कैसे करता है? अंतर्निहित व्यवसाय को देखें जो अपनी वार्षिक रिपोर्ट के माध्यम से सबसे अच्छा समझा जाता है और एक निश्चित बुनियादी अनुपात को देखें ताकि यह पता लगाया जा सके कि अंतर्निहित व्यवसाय सबसे अच्छे और सबसे खराब स्थिति में कितना रिटर्न उत्पन्न कर सकता है । उन कारकों को भी देखें जो व्यवसाय को प्रभावित करते हैं, उदाहरण के लिए, ऐसे क्षेत्र हैं जो अधिक ब्याज दर संवेदनशील हैं, जबकि अन्य नहीं हैं । अब जब ब्याज दरों में कमी आने की उम्मीद है, तो यह जांचना महत्वपूर्ण होगा कि कोई टेलविंड है जो किसी कंपनी के लिए उभरेगा या नहीं । यदि हाँ, तो आय में कुछ वृद्धि की उम्मीद की जानी चाहिए और तदनुसार निर्णय किए जाने चाहिए । नेट मार्जिन और आरओई के साथ मिड कैप स्टॉक 3 फरवरी, 2024 कंपनी त्रिवेणी टर्बाइन नाम एवीजी 9 स्कोर सिफारिश खरीदें विश्लेषक 6 गिनती उल्टा 44.3 संभावित % नेट 16.0 मार्जिन% आरओई% 26.2 आईएनएसटी हिस्सेदारी 25.0 मार्केट 11,671 रुपए सीआर कंपनी फ्यूजन माइक्रो फाइनेंस नाम एवीजी 10 स्कोर सिफारिश मजबूत खरीदें विश्लेषक 10 गिनती उल्टा 38.7 संभावित % नेट 22.7 मार्जिन% आरओई% 22.6 आईएनएसटी हिस्सेदारी 20.6 बाजार 5,947 कैप रुपये करोड़ कंपनी स्वच्छ विज्ञान और तकनीक नाम एवीजी 4 स्कोर रेको होल्ड विश्लेषक 11 गणना उल्टा 36.9 संभावित नेट 33,5 मार्जिन % आरओई% 28.2 आईएनएसटी हिस्सेदारी 8.6 बाजार 15,529 कैप रुपये करोड़ कंपनी नैटको फार्मा नाम औसत 9 स्कोर रेको होल्ड विश्लेषक 14 गणना उल्टा 31.6 संभावित नेट 31.6 मार्जिन % आरओई % आईएनएसटी 19.1 22.9 दाँव बाजार 15,388 कैप रुपये करोड़ कंपनी न्यूजेन सॉफ्टवेयर टेक नाम एवीजी 7 स्कोर सिफारिश खरीदें विश्लेषक 3 गणना * उल्टा 26.8 संभावित नेट 19.2 मार्जिन% आरओई% 21.9 आईएनएसटी 9.3 हिस्सेदारी बाजार 11,791 कैप रुपये करोड़ source: et

India Budget 2024: Key takeaways from Modi 2.0's last finance bill: India's interim Budget disappoints taxpayers with no changes to tax structure. However, the government focuses on fiscal consolidation, capital expenditure, and social welfare services. Finance Minister Sitharaman aims to reduce fiscal deficit to 4.5% of GDP by FY26. Revised fiscal deficit target is 5.8% of GDP for FY25. Here are the other top takeaways from the Interim budget While India's taxpayers didn't find much to cheer for in the interim Budget announced by Finance Minister Sitharaman, the Nirmala government continued on its path of fiscal consolidation with continued interest in capital expenditure and other social welfare services. Given the fact that this is the current government's final budget before nation goes to polls in April-May, Sitharaman stuck to the principle of fiscal prudence even as a slew of measures were announced targeting varied sectors. source: et

5 auto stocks with upside potential of up to 52%: A large part of the out- performance that stocks like TVS Motors & Tata Motors have seen in the last 2 years can be attributed to their moving early into the EV space. Let's go back a couple of years. The total amount which is real business is just Rs 150 crore, though the valuation has crossed more than a US $ one billion dollar. Valuations don't run business, they only get headlines. The reason why this is relevant is that a large old two wheeler company with which this startup is supposed to compete, its quarterly profit only is more than than 10 times this money raised by this start up. But because it is something which happens every quarter, it does not make it to the headlines. So, old two wheeler companies languished on the street as people are not able to relate it to EV opportunity just because it is not telling anyone what are its plans for EV space. This is done at a valuation which is far higher than headline hogging start up. Now because the fund which in one go is putting a billion dollars would do a major due diligence, that is actually an assurance that there is something right which the management is doing and that is why they are able to raise this money. If one goes through the annual report of all these companies, it is clear that they have all been working quietly and only very recently and that too very gradually they are opening up on their EV plans and that is what is resulting in the re- rating moves in some of them. Stay with the companies which have a track record of strong corporate governance and have an approach that they run business for making profit and not for making it headline. Auto Sector stocks - Upside potential Feb 2, 2024 Company Name TVS Motor Co Avg Score 5 Reco Hold Analyst Count 37 Upside Potential% 52.9 Inst Stake% 30.4 Market Cap Type Large 1Y Returns % Market Cap Rs Cr Company Name 95.9 94,873 Maruti Suzuki India Avg Score 9 Reco Buy Analyst Count 41 Upside Potential % 41.9 Inst Stake% 26.9 Market Cap Type Large 1Y Returns % Market Cap Rs Cr Company Name 21.3 334,256 Eicher Motors Avg Score 8 Reco Hold Analyst Count 38 Upside Potential% 24.6 Inst Stake% 27.8 Market Cap Type Large 1Y Returns % 19.1 Market Cap Rs Cr 107,681 Company Name Bajaj Auto Avg Score 10 Reco Hold Analyst Count 42 Upside Potential% 17.6 Inst Stake % 15.0 Market Cap Type Large 1Y Returns % 100.9 Market Cap Rs Cr 216,742 Company Name Hero MotoCorp Avg Score 9 Reco Buy Analyst Count 39 Upside Potential % 16.2 Inst Stake % 42.6 Market Cap Type Large 1Y Returns % 68.2 Market Cap Rs Cr 91.686 Calculated from highest price target given by analysts source:et

A fiscally tighter budget than market expectations: The FY26 budget is expected to be even tighter, with a lower fiscal deficit target. The government surprised everyone by not announcing any new social schemes or expanding existing ones. Allocation for popular social schemes like MNREGA and Jal Jeevan Mission remains unchanged. The budget focuses on boosting the investment cycle, with a significant increase in government capex, particularly on infrastructure projects. Sharper fiscal consolidation... FY25interim budget is fiscally much tighter than market expectations, which is remarkable, given the pressures of the upcoming elections. As against the market expectation of 5.3% of GDP as the fiscal deficit target for FY25, the government presented a fiscally more prudent budget, with a target of 5.1%. The finance minister also mentioned that the FY26 target is lower than 4.5%. The word 'lower' is a new addition which implies that FY26 budget could be even tighter. In the February'19 budget, the government had introduced Pradhan Mantri Kisan Samman Nidhi Yojana under which, the government distributed ₹6,000 to every farmer in 3 equal installments every year. The expectations were ripe that something similar could happen in this budget as well. But the government surprised everyone with no new social scheme announced or expanded. In fact, the government's revenue expenditure (a good proxy for total social spend) excluding interest payments is slated to decline by 1% Y-o-Y in FY25. Allocation for some of the popular social schemes like MNREGA, Jal Jeevan Mission etc remains unchanged for FY25. source:et

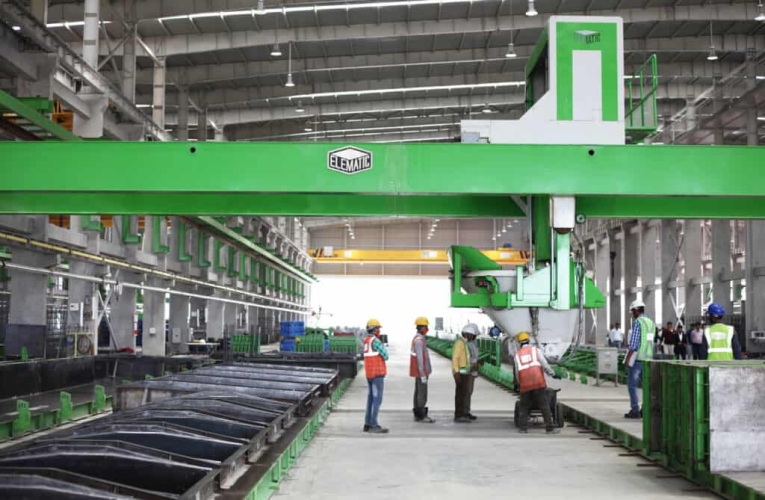

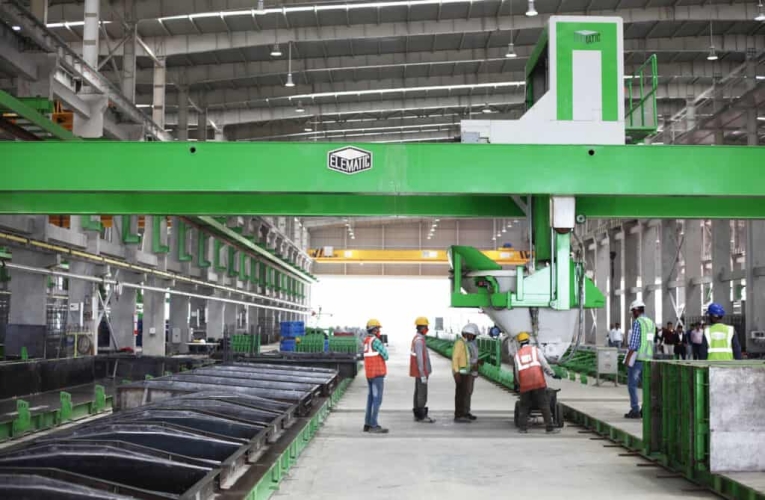

5 construction & contracting companies having upside potential of up to 30% While it was an interim budget, on one count it gave more indications even than a full budget. That count is the path which interest rates may follow. If one goes by the reaction of the debt market and the benchmark G-sec yield, the probability of interest rates coming down has increased very sharply. In an economy like India, where cost of capital matters more than anything else, many sectors will see positive impact. When it comes to companies, there are certain sectors which have stronger co-relationship with interest rates. The reason is that both the demand for their product and service and their own ability to grow and have better margins has strong co-relationship with interest rates. Let's take a look at the contracting and construction sector. In this case the demand comes from the government for large infrastructure projects including road airports and many others, and the government has to pay interest when it borrows, So when interest rates are lower, the government has more headroom to spend on infrastructure projects, which means higher demand for construction and contracting companies. While some might argue that governments are not very mindful of interest rates when deciding on projects, in reality the government is. Because overborrowing from the government finally leads to higher interest rates and higher inflation is a major side effect which means losing power which no government wants. The average score is based upon the five key pillars i.e. earnings, fundamentals, relative valuation, risk and price momentum. The data used in screening the following 5 construction stocks has been gathered from the latest Refinitiv's stock reports dated Feb 3rd, 2024. Construction Sector stocks - Upside potential Feb 3, 2024 Company Name Larsen and Toubro Avg Score 10 Reco Buy Analyst Count 34 Upside Potential % 30.3 Inst Stake% 46.6 Market Cap Type Large 1Y Returns % Market Cap Rs Cr Company Name 57.4 474,852 NCC Avg Score 8 Reco Buy Analyst Count 14 Upside Potential% 20.4 Inst Stake % 24.2 Market Cap Type Mid 1Y Returns% 132.7 Market Cap Rs Cr 13,511 Company Name PSP Projects Avg Score 7 Reco Strong Buy Analyst Count 7 Upside Potential % 19.3 Inst Stake% 7.3 Market Cap Type Small 1Y Returns % 12.0 Market Cap Rs Cr 2,777 Company Name Ahluwalia Contracts Avg Score 8 Reco Hold Analyst Count 11 Upside Potential % 6.3 Inst Stake% 36.6 Market Cap Type Mid 1Y Returns % 78.2 Market Cap Rs Cr 5,794 Company Name ITD Cementation Avg Score 9 Reco Buy Analyst Count 3 Upside Potential% 3.6 Inst Stake% 5.4 Market Cap Type Mid 1Y Returns% 205.6 Market Cap Rs Cr 5,436 Calculated from highest price target given by analysts source: et

5 midcap stocks with right RoE and upside potential of up to 44%: In a market where bulls are ruling every corner of the street, and stocks are either fairly valued or overvalued. The big question is how does one take care of the basic aspect of buying good quality stocks at reasonable valuations. Buying quality stocks should be one of the basic principles while investing in markets. But when one is buying mid- cap stocks this principle becomes even more important for multiple reasons and specially at a time when valuations are not cheap and small corrections can lead to strong negative reaction in stock prices. Now how does one do it? Look at the underlying business which is best understood by going through its annual report and look at a certain basic ratio in order to figure out how much returns that underlying business can generate in best and worst case. Also look at the factors which impact the business, for example, there are sectors which are more interest rate sensitive, while others are not. Now that interest rates are expected to come down, it would be important to check whether there is a tailwind which will emerge for a company or not. If yes, then some boost to earnings should be expected and decisions should be made accordingly. Mid Cap Stocks with Net Margin & RoE Feb 3, 2024 Company Triveni Turbine Name Avg 9 Score Reco Buy Analyst 6 Count Upside 44.3 Potential % Net 16.0 Margin% RoE% 26.2 Inst Stake 25.0 Market 11,671 Cap Rs Cr Company Fusion Micro Finance Name Avg 10 Score Reco Strong Buy Analyst 10 Count Upside 38.7 Potential % Net 22.7 Margin% RoE% 22.6 Inst Stake 20.6 Market 5,947 Cap Rs Cr Company Clean Science & Tech Name Avg 4 Score Reco Hold Analyst 11 Count Upside 36.9 Potential Net 33,5 Margin % RoE% 28.2 Inst Stake 8.6 Market 15,529 Cap Rs Cr Company Natco Pharma Name Avg 9 Score Reco Hold Analyst 14 Count Upside 31.6 Potential Net 31.6 Margin % RoE% Inst 19.1 22.9 Stake Market 15,388 Cap Rs Cr Company Newgen Software Tech Name Avg 7 Score Reco Buy Analyst 3 Count * Upside 26.8 Potential Net 19.2 Margin% RoE% 21.9 Inst 9.3 Stake Market 11,791 Cap Rs Cr source:et

राडार:एक साल में 18% बढ़ा क्रेडिटकेयर: माइक्रोफाइनेंस उद्योग में एक प्रमुख खिलाड़ी सैटिन क्रेडिटकेयर नेटवर्क ने विलंब को कम कर दिया है और एयूएम विकास को चलाते हुए उधार देना फिर से शुरू कर दिया है । कंपनी ने अपनी बैलेंस शीट, जोखिम मूल्यांकन और अंडरराइटिंग प्रथाओं को मजबूत किया है । इसने अपनी पूंजी जुटाने की योजना पूरी कर ली है और पूंजी पर्याप्तता में सुधार किया है । आर्थिक स्थिति में सुधार के साथ, माइक्रोफाइनेंस उद्योग के बढ़ते रहने की उम्मीद है । माइक्रोफाइनेंस उद्योग ने मजबूत वृद्धि देखी है और आर्थिक परिदृश्य में सुधार के साथ, गति जारी रहने की उम्मीद है । कंपनी के प्रबंधन ने 25% की एयूएम वृद्धि और 3.5% की आरओए वित्त वर्ष 24 के लिए निर्देशित किया है । सैटिन क्रेडिटकेयर ने चुनौतियों को सफलतापूर्वक नेविगेट किया है और निकट और दीर्घकालिक पर इसकी विकास संभावनाओं पर केंद्रित है । कंपनी ने एच 1 वित्त वर्ष 24 में अपने लाभप्रदता मेट्रिक्स में सुधार देखा, पिछले तीन वित्त वर्ष में कमजोर लाभप्रदता देखने के बाद कोविड -19 महामारी के कारण इसके संचालन और परिसंपत्ति गुणवत्ता पर प्रभाव पड़ा । स्टॉक वर्तमान में वित्त वर्ष 26 अनुमानों के आधार पर अपने मूल्य-से-बुक मूल्य के 0.8 गुना पर ट्रेड करता है, जो आने वाले वर्षों में वृद्धि की संभावना को देखते हुए एचडीएफसी सिक्योरिटीज के दृष्टिकोण में आकर्षक है. source: et

एलआईसी हाउसिंग फाइनेंस: साइड में तेजी: एलआईसी हाउसिंग फाइनेंस का दैनिक रुझान बग़ल में है । मासिक, साप्ताहिक और दैनिक के लिए आरएसआई तेजी दिखा रहा है । विकल्प श्रृंखला विश्लेषण के आधार पर, सीमा 600 और 650 के बीच है । आइए इसके आसपास एक व्यापार की योजना बनाएं । एलआईसी हाउसिंग फाइनेंस का दैनिक रुझान बग़ल में है । मासिक, साप्ताहिक और दैनिक के लिए आरएसआई तेजी दिखा रहा है । डेटा के आधार पर, पुट साइड पर इसका अधिकतम ओपन इंटरेस्ट स्ट्राइक 600 पर है; और कॉल साइड पर, यह 650 पर है । हम मान रहे हैं कि यह ज्यादातर समय 610 और 650 के बीच बिताएगा । हम अल्पकालिक गैर-दिशात्मक रणनीति लेने के लिए एक छोटी लोहे की कोंडोर रणनीति की सिफारिश कर रहे हैं । एक प्रविष्टि पर विचार किया जा सकता है यदि कीमत 610 और 650 के बीच है । यह एक क्रेडिट रणनीति है जिसमें अधिकतम जोखिम लगभग रु । 23,600 प्रति लॉट। मात्रा श्रृंखला (बहुत) पुट / पुट खरीदें / बेचें प्रीमियम 600.00 1 29 - फरवरी-2024 29 फरवरी - 2024 29 - फरवरी-2024 29 - फरवरी-2024 अधिकतम लाभ क्षमता 10.15 डाल दिया बेचना 660.00 1 13.55 कॉल करें बेचना 580.00 1 5.80 डाल दिया खरीदें 680.00 1 9.70 कॉल करें खरीदें रु. 16,400 अधिकतम हानि जोखिम रु.-23.600 यदि स्पॉट स्तर ऊपर जाता है तो रणनीति से बाहर निकलें यदि स्पॉट स्तर नीचे चला जाता है तो रणनीति से बाहर निकलें यदि एमटीएम हानि से अधिक है तो बाहर निकलें समय से बाहर निकलें 672 588 6600 श्रृंखला के अंतिम शुक्रवार 668.20 ऊपरी सुरक्षा कम सुरक्षा। 591.80 source: et

Feb 04 2024, 11:34

- Whatsapp

- Facebook

- Linkedin

- Google Plus

0